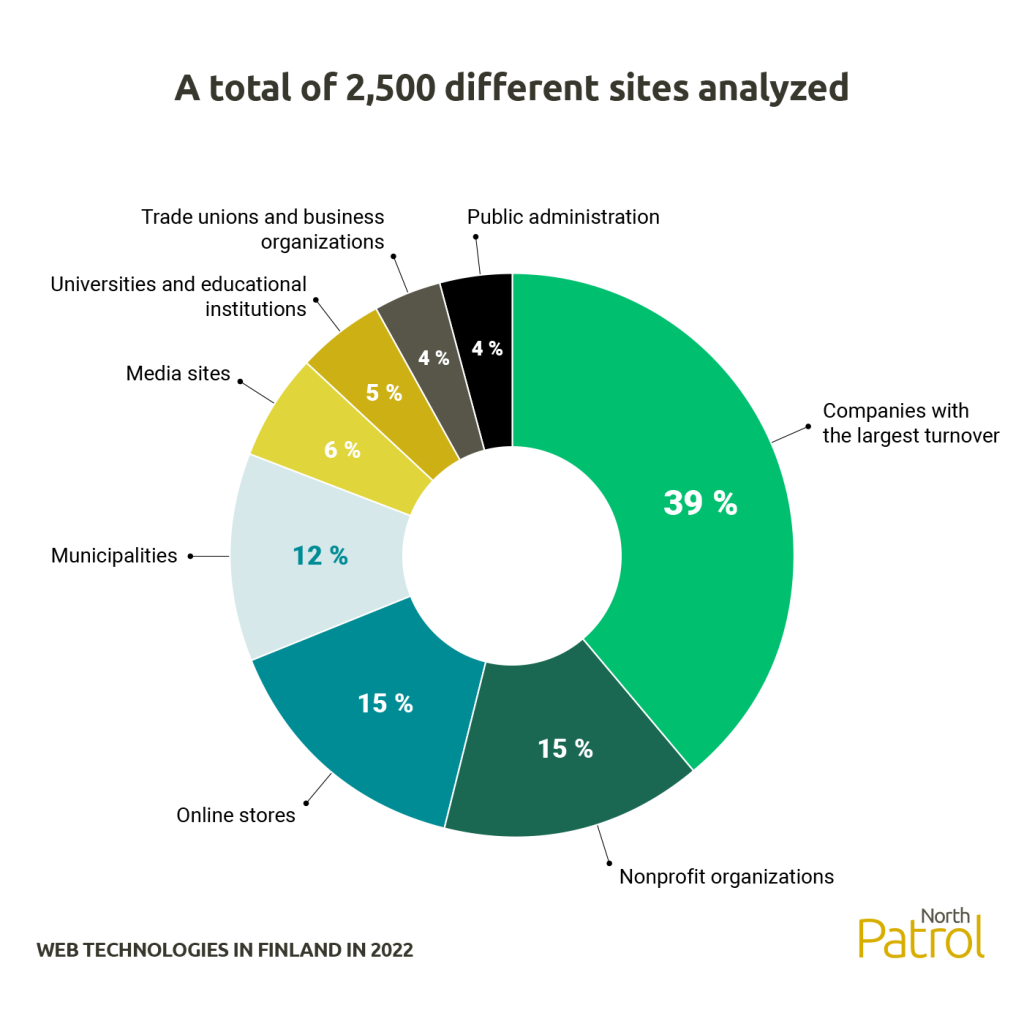

In previous years, North Patrol has analyzed e-commerce systems, web content management systems, intranets, and many other categories. This year, we decided to do a broader report that broadly looks at organizations’ online services, taking into account e-commerce platforms, web content management systems, and customized solutions. As many as 2,500 sites of different organizations were selected for the report, so this is certainly the largest technology analysis done in Finland in this area. Large and medium-sized businesses form the largest group, but public administration, municipalities and nonprofit organizations are also involved in decent numbers.

North Patrol is a consulting firm specialized in the design of digital services and information systems. We shape ideas into a vision and service concept, find the best architectural and technological solutions, design a functional user experience, and compete to find the ideal partner for implementation work. We do not sell implementation projects, nor do we sell licenses; we are genuinely on the side of the customer.

This article is a part of CMS selection article series by North Patrol.

North Patrol helps customers to make smart technology decisions and find the best implementation partners. Typically, we facilitate prestudy projects and evaluate vendors and proposals. Most of our clients are large companies headquartered in Finland.

The theme of the review was the tools for building modern online services in 2022. Today, product-based solutions represent only one model of building an online service. Many organizations that invest heavily in digital channels also implement their digital services as largely customized solutions. Therefore, the review also aimed to analyze the technologies for these more customized solutions. No one builds online services today completely from scratch, but uses at least different open-source libraries or component collections as a basis. Indeed, these libraries and collections are almost as important today as more productized platform solutions. This review includes all of these different implementation models.

The results of the study were also analyzed in a webinar in the spring of 2022 by Perttu Tolvanen and Kimmo Parkkinen. The webinar also answered questions from participants. Watch the webinar recording here (in Finnish).

Review into 2500 websites

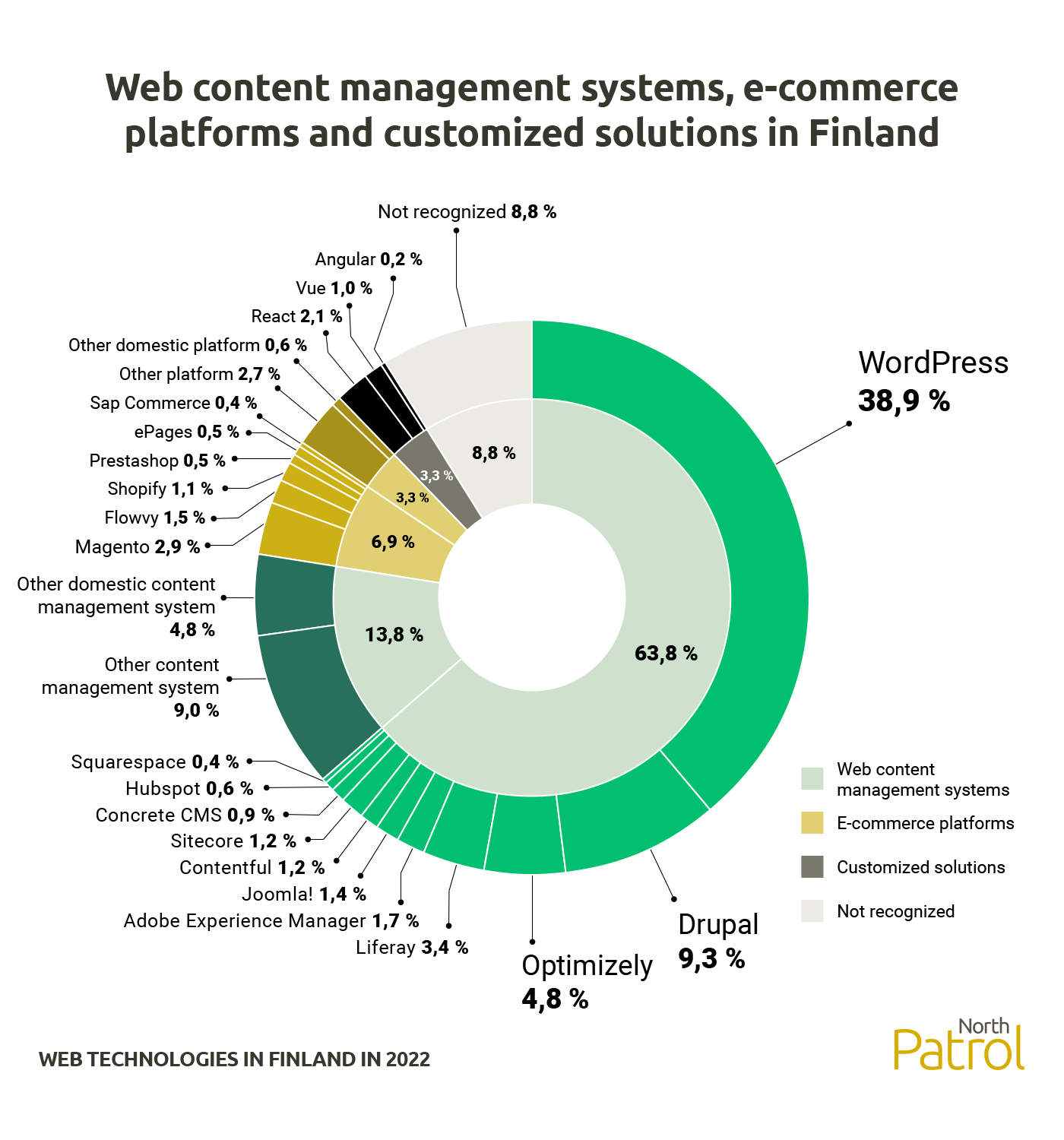

The sample of the study was 2,500 main sites of different organizations or brands, intending to identify the main technologies used by them. The principle was to include one website per organization. In the sample, the sites were divided into the following categories:

The survey did not extend to the technologies used for the subdomains of these organizations. By restricting the number of sites of an individual organization, the review sought to minimize the impact of different publishing strategies on results. Many companies may have a lot of sites in different domains that are implemented with the same technology, so including multiple sites in the review would have affected the results. In this way, the results can be considered quite representative from the point of view of the number of customer organizations.

We utilized the commercial BuiltWith service, which provided paid analysis on all sites in the sample. Additionally, the accuracy was supplemented by an analysis from two other technology radars as well as manual analysis by our North Patrol experts.

The most used implementation technologies

The implementation models and technologies used for online services have always been very diverse throughout the history of the internet. This diversity is still there although websites have been developed using pretty much the same basic technologies for more than 20 years. It can even be argued that variability has only increased in recent years, as implementation models that rely heavily on Javascript, for example, have risen alongside more traditional models.

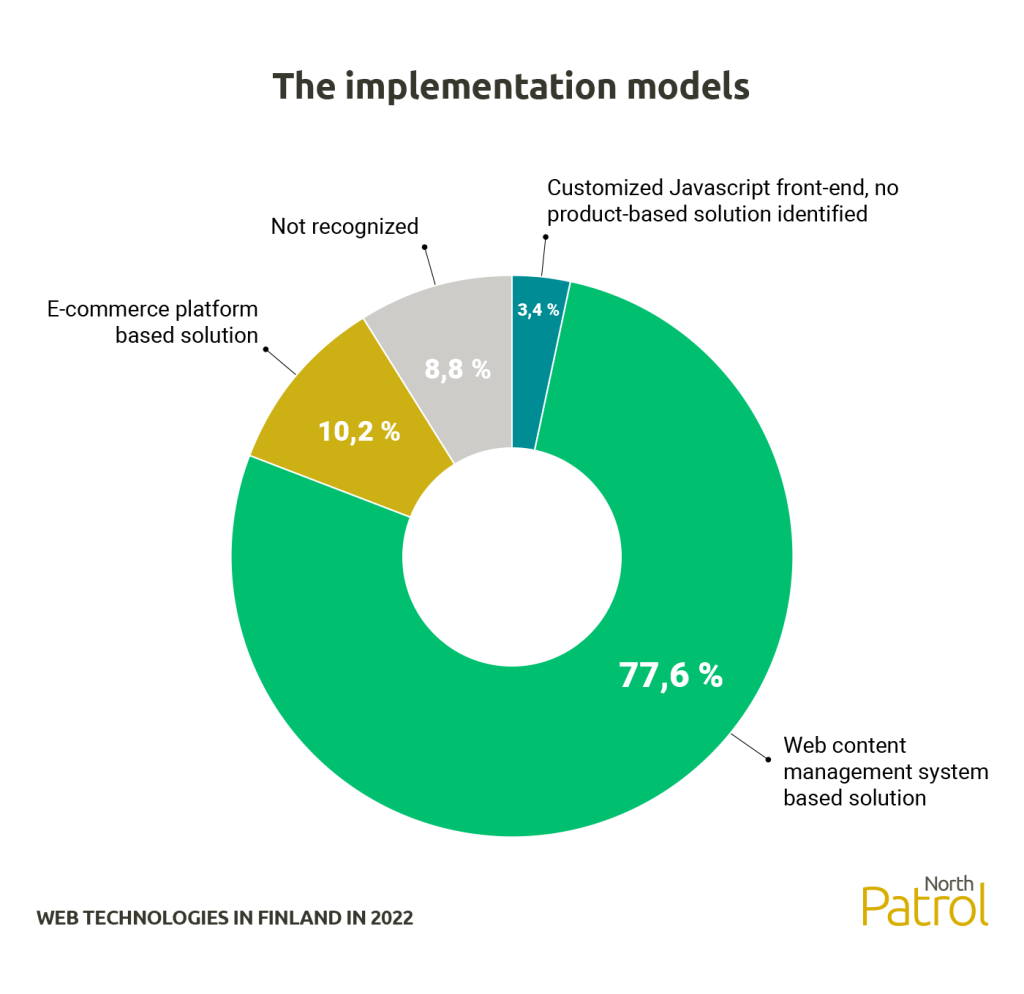

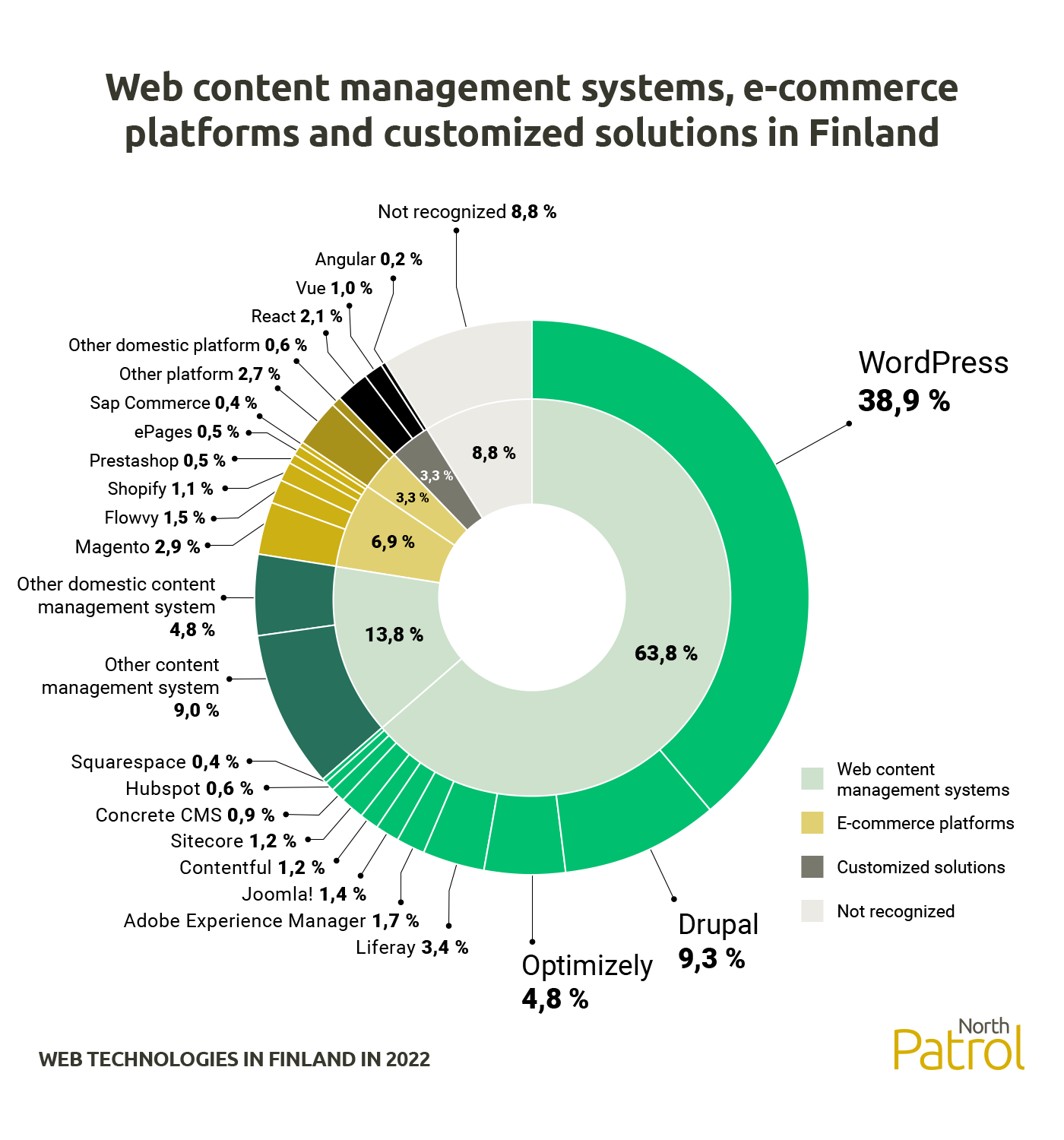

Nearly 80 percent of online services are implemented using a web content management system

Web content management systems (77.6%) still dominate the market. Fully customized solutions (3.4%) are a rather rare solution model when looking at the big picture. The share of e-commerce platforms (10.2%) is also quite small. However, many have an online store as a separate service, for example using a separate domain such as shop.business.com. The same goes for partially customized solutions, many have a custom-built application or self-service channel, but it is a separate part of the main site.

Many e-commerce sites are nowadays being built on a web content management system with capable e-commerce functionality. For example, WordPress' WooCommerce is probably the most popular e-commerce solution in the world, but here it is classified as a web content management system. Therefore, the share of e-commerce in the total may well be more than that 10 percent - we are probably talking about a market share between 10 and 20 percent.

Customized solutions are for special situations

Compared to the industry's internal discussion and sales speeches, perhaps the most interesting finding is the small share of customized solutions. Based on sales talks and discussion, that share could be expected to be much larger, but in practice web content management systems and e-commerce platforms dominate the market without any doubt. Of course, a lot of customized solutions are made, and usually using bigger budgets, but at least in the implementation of online services, their percentage share is not very high. Indeed, the role of customized solutions is typically complementary, not dominant. The site may utilize a web content management system as its main technology, but there may also be a large custom entity inside the site, such as an appointment application or a product configuration tool.

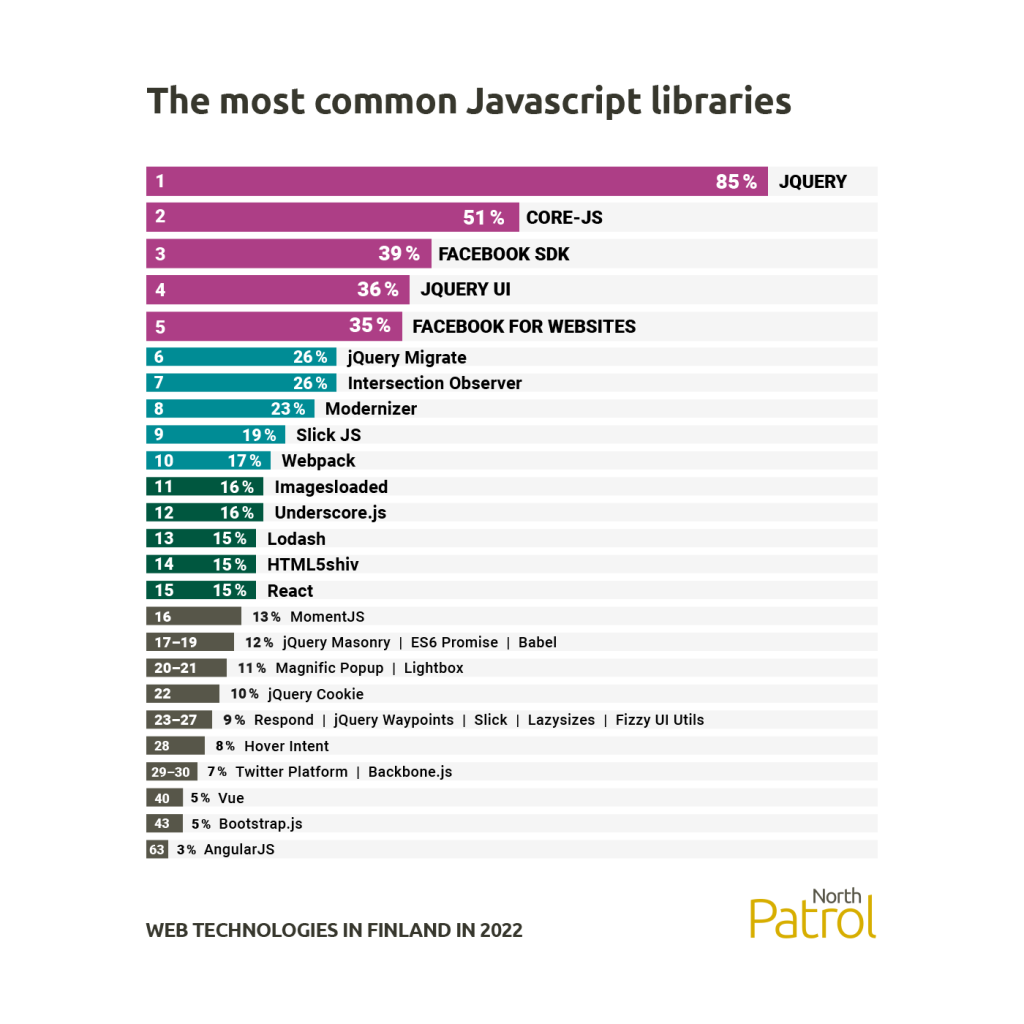

The variety in the Javascript world is huge

The prevalence of custom sections as a partial solution is also supported by our study of Javascript technologies. For example, React is found on 15 percent of the sites in the sample, and React doesn’t usually do any small stuff but large web applications. Although not many have fully customized solutions, quite a large number of sites have some fairly customized functionality. The huge variety and rapid rate of change in Javascript technologies are also noteworthy. AngularJS framework, which was widely used only a few years ago, accounts for only 3 percent of this study sample.

The variety of Javascript technologies is primarily due to the fact that many libraries have become a necessity needed on almost every site. For example, the Jquery library can be found on 85 percent of the reviewed sites. There are also a lot of small libraries in the Javascript world. These small libraries can solve something quite small, but they do it so well that a large number of sites use this small library for that specific purpose.

When looking at larger Javascript frameworks, React (15%) is found to be the most popular in its class. In recent years, Vue has risen in popularity among digital agencies, but in this review it lags far behind React, reaching only 5 percent.

Open-source dominates the world of Javascript

It's noteworthy how dominant the use of open source code is when it comes to technologies used to build the website. In Javascript frameworks, open-source is practically the rule, not the exception.

This is also a key reason for the pace of the market change. When there are no companies behind the technologies for which that technology would be a core business, changes in trends can be rapid and some application frameworks can be left out fast. And while there have been big technology companies behind some of the projects, like Google and Facebook, some of the application frameworks favored by these companies have quickly become outdated as technology giants themselves have switched to newer options. For digital agencies doing projects, this is not crucial as, even if technologies change rapidly, the field of customized solutions from the customer's point of view is still quite challenging to navigate.

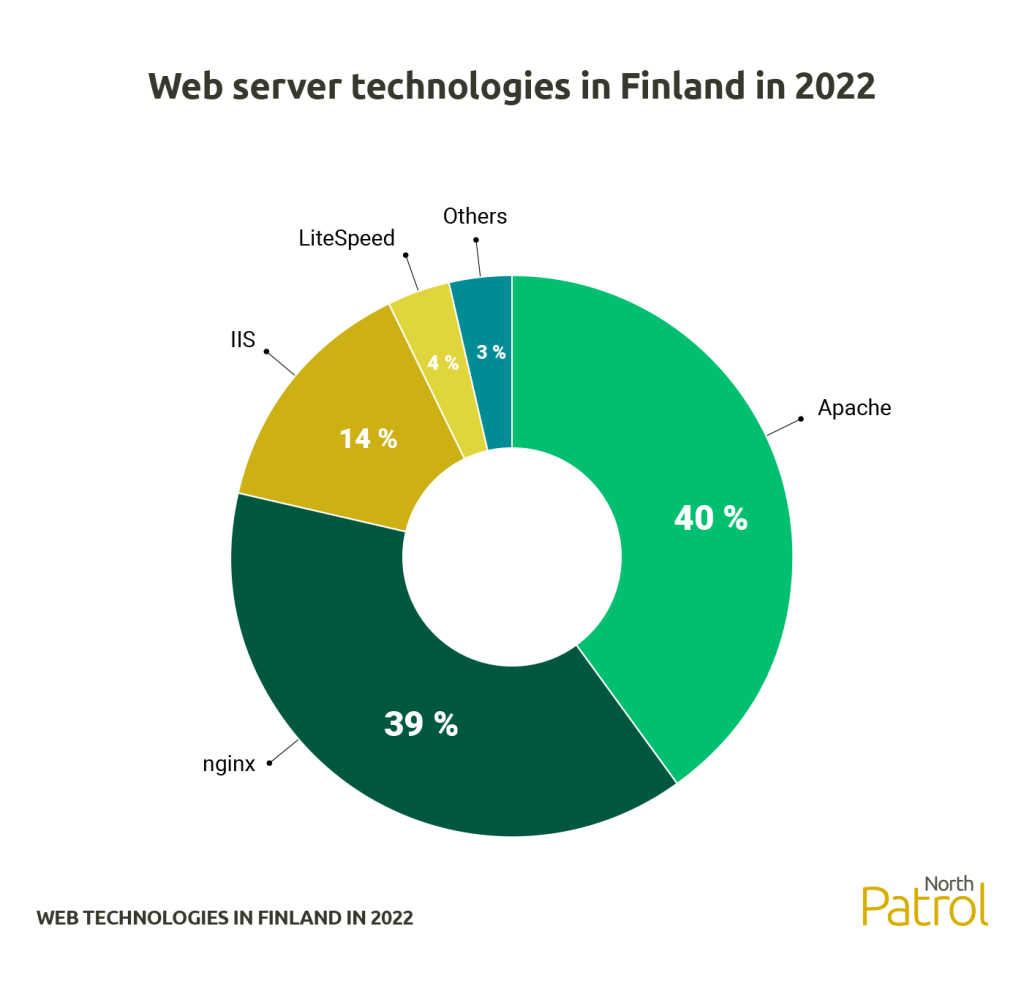

Open source dominates when it comes to web server technologies

The lower the technology stack, the more open source dominates the website implementations. When looking into web server technologies, Apache and Nginx have together a share as high as 79 percent. Microsoft's IIS server's share is only 14 percent, although Finland has traditionally been a very strong Microsoft country.

Web server technologies are also a good example of the fact that, despite their long history, they have not ended up in a completely monopolistic situation, although the early variety of technologies has shifted to a few dominant technologies.

The dominance of open-source is also understandable when it comes to technologies that have been in use for a long time, even decades. Many such open source projects are no longer developed by amateurs as a hobby, but most technologies are surrounded by large communities and a large number of companies that support projects with significant sums of money. In practice, the product development budget for many open source projects can be much larger than the project development budgets for so-called leading commercial products. However, the situation varies greatly from technology to technology. For example, Javascript frameworks are not yet at such a development point.

The variety is really wide, even in web content management systems

Despite its long history, the variety of web technology is also very large for web content management and e-commerce products. There are still dozens of web content management products, even though the market has seen quite a variety of stages in 20 years. In this study, too, we found as many as 13 technologies in Finland with a market share of at least one (1) percent.

The king of web content management systems is WordPress, which is home to nearly 40 percent of the review’s online services. The difference with Drupal coming in second is almost 30 percent, with Drupal remaining just under 10 percent. In terms of the number of customers, WordPress is in a completely superior position in the market.

The third-place goes to Optimizely (formerly Episerver), at just under 5%. In fourth place is Liferay with a share of just over three percent. Fifth is the e-commerce platform Magento by just under 3%. The Javascript framework React reaches a share of over 2%. Together, these six largest individual technologies account for more than 50% of the survey’s online services.

WordPress (38.9%) has become a kind of a “de facto system” for many things

Statistically, it is quite significant that open source-based WordPress has succeeded in capturing several tens of percent of the websites around the world, and now also in Finland. No single product has ever had such a market share in the history of the web.

The large market share of WordPress is explained by several favorable trends. The biggest reason for its popularity is probably its suitability for small and medium-sized online services that do not require more expensive and robust platforms. This has made WordPress appealing to a lot of customers and has also made it a very suitable tool for small digital offices. After all, many small and medium-sized digital and advertising agencies in Finland serve the SME field, whose needs are well suited for WordPress. In recent years, WordPress’ powerful e-commerce extension, WooCommerce, has also been a key reason for the platform’s popularity in the SME field.

The popularity of WordPress among the world’s media houses has also been an important credibility factor in attracting larger organizations. While WordPress is profiling itself as a cost-effective platform for small and medium-sized sites, it can be sold to the management team as a platform used by the world’s largest media houses. This rather rare combination has been one of the key factors in WordPress gaining widespread popularity.

However, few believe WordPress’s growth will continue toward complete market control. The diversity of online services is so vast that it is hard to imagine a single technology being suitable for everything. One could even predict that if WordPress seeks to expand its territory significantly, a strong market position could begin to crumble precisely because of this excessive desire to expand for every use.

Until now, WordPress’s winning streak has been based on strong specialization. It has not tried to solve all problems out there and has not gone out of its way to support all the features that the community has asked of it. One could even say that WordPress has stayed focused on many of the basic requirements of web publishing, and has been successful in this.

Drupal (9.3%) is the choice of many large public administration organizations

Drupal's position as the second most common platform is very strong, although there has been no similar hype around the platform in recent years as it did some years ago. Many agencies specialized in Drupal have also been acquired or merged with other Drupal agencies. In this way, the field of suppliers has narrowed, and in Finland, there are mainly only offices that do large Drupal contracts or sell developer resources to customers for their work management. However, this situation is quite suitable for many customers, as Drupal has in many ways found its place as a web platform for large organizations. Large user groups include large cities and universities, all of which invest significant sums in their online services and require versatility in their technical platform.

Versatility is what can be considered Drupal's strength. As a content management tool, it is very flexible and can in many ways, for example, manage content coming through integrations. Drupal's strengths also include a wide range of user management capabilities. Based on these strengths alone, Drupal tends to appeal to organizations that may have hundreds of content providers involved in online content production.

When it comes to customer numbers, it is still likely that Drupal's market share will decrease slightly in the future. Many medium-sized organizations have moved to WordPress in recent years, and although large customers are investing up to millions of euros in their Drupal development, there are no longer as many new customers entering the Drupal community as in previous years. All in all, Drupal is going great and is the pretty clear king of bigger platforms.

Optimizely (4.8%) is the choice of large international companies

Optimizely has managed to maintain its market position in Finland quite well, although the rise in prices has been the most talked-about issue in recent years. Large companies, in particular, have remained Optimizely's customers, and some web stores have also been built on Optimizely. Indeed, the platform has clear strengths that are not found in many other competitors. In particular, personalization and targeting capabilities are in a class of their own, so companies that invest in this area are likely to choose Optimization also in the future.

The multilingual management features needed by many international organizations are also highly developed in Optimizely. Therefore, such organizations are likely to continue to pay for their licenses, even if they do not necessarily take advantage of personalization capabilities, for example. There are still strong implementation partners in Finland, as there are several large digital offices in Finland that use Microsoft technologies.

Optimizely has, however, lost quite a bit of a foothold for WordPress and Drupal in recent years, as public administration, in particular, has moved to open source platforms with Optimizely’s new pricing policy.

Liferay (3.4%) is the government's preferred web content management system

Liferay also belongs to the systems that have lost market share to the top two. Liferay, however, has managed to keep the state administration as a strong stronghold, as the YJA platform coordinated by Valtori has only expanded in recent years. Thus, when looking at the number of sites, Liferay may even be on an upswing. However, most of the growth comes from one customer, Valtori's YJA platform, which is maintained by one partner chosen by Valtori.

The use of Liferay in the private sector has been in a clear downturn, and since the YJA platform is indeed the contract of only one Liferay partner, Liferay's market position cannot be maintained on a particularly strong footing. Custom-made solutions especially have been a tough competitor for Liferay in recent years. The downturn has also been affected by the relatively low use of the open-source version of Liferay today, as even the largest public sector customers have switched to the commercial version.

But like Optimize, Liferay has its strengths. Liferay is a particularly capable platform for online services with a large number of logged-in users and when different content and functionality is offered to different users. Therefore, the system has its market and function, although in terms of volume its share may be getting less.

Magento (2.9%) runs large web stores

Magento is a long-standing online store platform that has had a large market position in Finland for a long time. Admittedly, Adobe's entry into ownership has significantly changed the platform's target audience. Today, it can be said that Magento is mainly a platform for very demanding online stores for big companies. In Finland, a considerable part of the retailer-type large online stores are already on top of Magento, and probably will continue to be so. Magento's capabilities are very suitable, especially for large-scale product stores and demanding B2B online stores.

The biggest change in the Magento market is likely to be for smaller players who have built their online store on top of the open-source version of Magento, but who do not have sufficient development resources to continue with Magento, and the commercial version offered by Adobe is not an option. This will certainly reduce Magento's share in terms of volume, although its market share in euros is likely to only increase. This especially affects Finland, as a significant proportion of Magento online stores in Finland utilize the open-source version.

The change in Magento has been analyzed more extensively in recent articles by North Patrol. Also, our webinar (in Finnish), which analyzes the results of the review, talks a little more about what the future holds for Magento.

React (2.1%) dominates the market for customized solutions

In Finland, the market for customized web solutions has been in a clear growth cycle in recent years, as many large custom-builders have actively sold the benefits of customized solutions to their customers. Admittedly, custom web development in recent years has in practice meant development on top of a fairly extensive and versatile Javascript application framework, so that the result is very customer-specific, but also bound to that framework and its future updates and changes.

The React framework (2.1%) created by Facebook has been by far the most popular Javascript framework in recent years as a technology for these fully customized online services. In this review, too, the difference between the Vue application framework in second place is quite clear. Vue was the dominant technology in only one (1) % of the review sites. The previously popular Angular fell far behind the top two, gaining just 0.2 % of the share. React's strong position is emphasized by the fact that, as a partial solution, it was found on as many as 15 % of the review sites, while Vue's share as a partial solution was 5 %.

In general, the advantages of customized UI layers are speed from the user's point of view, as well as easier opportunities for developers to make changes to the service. Of these advantages, however, the speed advantage has been questioned in many implementations, as it requires a very well-built outcome, and this has not been the case in many implementations.

For online services, the key benefits of custom solutions relate to the developers' work experience, because for custom solutions, the development team does not need to have in-depth knowledge of any product-based platform, and development and testing practices can be built according to the development team's preferences. Custom solutions are the most typical for in-house development teams, as such teams typically have established ways of doing things, and taking over a product-based solution can be a tedious task from the team´s perspective compared to a more customized solution model.

From the users' point of view, the advantages of customized solutions are emphasized in situations where the user interfaces have been made application-like and different from the typical website models. For example, domestic food web stores have such features, so it is understandable from that point of view that the user interface layers visible to their users have been made as a rather customized solution. It's the same case when it comes to many digital self-service channels, whose processes are very specific so that each step of the user interface is practically a customized view.

Customized solutions can be expected to become more common for at least some time to come. This is because there are likely to be a lot of things that aren’t properly implemented as a ready-made solution and many of these are complex processes that are likely to require a customized solution, at least for the interface layer. React is also a remarkably popular technology among developers, as many developers see mastering it as an effective way to advance in their careers. Indeed, there is a strong demand for React developers, and this in part is also driving the popularity of this technology at the moment.

However, the market for Javascript frameworks has changed rapidly in recent years, and React's position is far from strong. A significant portion of the popularity is also based on the React Native framework, which enables the implementation of a web and mobile applications from the same code base. This has its place, but as the popularity of mobile apps has not grown in recent years, this trend is not necessarily in favor of a significant expansion of React usage either.

In the very diverse technology field of customized solutions, React is surely dominating the market at the moment.

Adobe Experience Manager (1.7%) is the choice of international mega organizations

Adobe's web publishing system is one of the largest and most expensive products on the market, usually competing with, for example, the Danish Sitecore. In Finland, Adobe Experience Manager does not have its presence, nor does it have active implementation partners. Adobe’s share of this list is based on the online services of large international corporations made globally on the Adobe platform. Typically, organizations using Adobe have hundreds of different and multilingual online services around the world because the system has been developed to manage such large entities.

As a Java-based platform, Adobe Experience Manager has never really gained popularity in Finland, because there are no digital offices in Finland that specialize in Java technology. Most of the Finnish Java offices have focused on implementing customized solutions.

Flowvy (1.5%) is the ERP and web store platform for store chains

Flowvy is a Finnish e-commerce platform (the main owner today being a Swedish company) that has managed to expand to a versatile retail ERP system with the web store platform being one part of the entity. Flowvy is typically operated by a small to a medium-sized retail chain with multiple stores and warehouses in different cities. Flowvy's e-commerce solution enables such a chain of stores to implement and run cost-effective e-commerce.

Joomla (1,4 %) is still hanging on

Joomla is a surprise on this list. Many may have imagined that Joomla died years ago, but this very popular open-source web content management system at the time is still stubbornly hanging on. There are still a few small Joomla agencies, so Joomla still has websites for both companies and municipalities. The Joomla community can no longer be called very active, and the partner network in Finland is also very small, so from the customer's point of view, choosing Joomla for a new project is a rather risky business in the current market situation.

Contentful (1.2%) fills in the gaps in custom solutions

Contentful should be talked about as a support service for custom solutions or some kind of sub-solution. Contentful cannot be thought of as a standalone tool or platform, because Contentful is just a content management tool that offers virtually no model for building the online services themselves. Typically, Contentful has been used, for example, in the implementation of customized user interface solutions for self-service channels, as a support service that makes the text and image elements of the user interface easier to manage, and therefore serves the customer's marketing department that would not otherwise have easy access to the customized solution.

Today, there are offices in Finland that sell customers a complete solution where they offer the implementation of an online service or e-commerce in practice as a customized solution, for example, based on a combination of React and Contentful. Such a model may be appropriate, for example, if all the content of the customer's online service comes from back-end systems through integration, or the customer does not need a versatile web content management system or e-commerce platform for other reasons. In this case, Contentful may be a sufficient tool for content management.

Sitecore (1.2%) competes with Optimizely

The Danish Sitecore has always been Optimizely's “big brother”, representing a broader and heavier system, but today the race between the two is much more even. Optimizely has grown into another league in recent years, catching up with Sitecore in many areas.

Admittedly, Sitecore has also risen to the next leagues, typically competing with Adobe for the biggest customer base globally.

There have always been some Sitecore customers in Finland, as many digital agencies using Microsoft technologies have made sites with Sitecore over the years. Sitecore's features, like Adobe's and Optimizely's, are designed primarily for global corporations with dozens of different markets and language versions.

Shopify (1.1%) runs small web stores for products

The Canadian SaaS service Shopify has come to Finland in recent years, taking market share, especially from small domestic providers. As an e-commerce platform, it has focused on selling products as much as possible using a productized platform. As users, Shopify has especially small and medium-sized SMEs in Finland, but also somewhat larger groups that choose Shopify because of its extensive international support. A big international platform offers a fast route to open online stores in many different markets.

Shopify is the only real SaaS service on this list that a customer organization can implement, if necessary, even with a few hours of configuration work. Therefore, SaaS solutions cannot be considered a very big phenomenon in this area yet, but on the other hand, Shopify is also a good example of what the future of this area could be - at least from the perspective of online services for small and medium-sized businesses.

Vue (1.0%) challenges React in Javascript frameworks

Vue is a React-like Javascript framework that has become a favourite of many digital offices over the past couple of years due to its simpler and clearer structure (at least according to some users). Compared to React, Vue is generally a faster and simpler application framework for implementing smaller custom entities, while React is designed more as a platform for large and highly complex web applications.

Therefore, more popularity can be predicted for Vue because numerically, online services need more small and medium-sized custom sections (such as a self-service channel, custom form, a special search interface, or product configurator) than very large web applications.

Concrete CMS (0.9%) is a small challenger for WordPress

Concrete CMS is an open-source web content management product with a reasonably long history and a reasonable community around it. As a PHP-based solution, it competes especially with WordPress for the popularity of digital offices. Concrete CMS attracts many offices for its clarity and simplicity. One could say that Concrete CMS is a more traditional web content management system than WordPress, whose blog history is still reflected in many of its features.

Concrete CMS is hardly able to challenge WordPress anymore, and the system's market share is by no means on the rise, but perhaps there are enough people and offices in Finland who, for one reason or another, don't like WordPress and need an alternative. This is what Concrete CMS offers. Functionally, Concrete CMS doesn’t offer anything that WordPress wouldn’t offer, and from a customer perspective, the broad WordPress partner field and community usually pushes the choice in the direction of WordPress.

HubSpot (0.6%) attracts B2B marketers

HubSpot is also part of a long line of products but seems to have only raised its head in Finland in recent years. The recently revamped side of the web content management system has also clearly increased the interest of digital agencies in this range of products specializing in B2B marketing. The functionalities of HubSpot are answering especially the needs of B2B marketing sites where lead capturing and nurturing is crucial. Due to its narrow specialization, Hubspot can hardly grow into a big fish in Finland, but there are still enough B2B companies in Finland, for which HubSpot may be a suitable solution in some situations.

Squarespace (0.4%) challenges domestic website builders

Although Squarespace's market share is still very small, it is a surprising market share for such a fully self-contained website platform, as this review has mostly looked at the websites of fairly large organizations. To have ranked even in some way in this review is therefore surprising. Squarespace is, of course, a long-standing provider that strives from New York and has always profiled itself as a slightly more design-driven website solution than its many more commercially oriented competitors. Squarespace has also been used in Finland for a long time, but it has always remained a marginal solution.

For example, based on scan data published by the Builtwith technology radar, Squarespace already has more than 5,000 sites in Finland. This is more than, for example, Shopify, which ranks better in this review. Therefore, Squarespace can perhaps be considered larger in size here, which is not necessarily rising to challenge the more robust solutions on this listing, but is already quite a big deal in Finland when it comes to smaller and simpler sites.

The future looks fragmented

Small domestic products have largely died out of the domestic market, but these have been replaced by a wealth of international solutions that tend to specialize in certain scenarios. Therefore, simplification of the market does not seem very likely, perhaps even the opposite. From a customer perspective, there are more and more options that can answer their needs.

The change has been noticeable, especially for large commercial platforms, which are increasingly specializing in some narrow sectors, leaving WordPress and Drupal a lot of space as a kind of general solution. In Finland, Optimizely's position, in particular, has gotten smaller and is likely to continue to decline.

SaaS solutions challenge WordPress when it comes to smaller customers

In the future, the relative market position of WordPress and Drupal is likely to grow as large commercial platforms continue to specialize, leaving room for WordPress and Drupal in the market. However, the rise of SaaS solutions is also diversifying the market, bringing more and more attractive options to small and medium-sized customers.

Saas solutions can therefore offer very good value for money if the features of the solution meet the needs. However, the choice of SaaS solutions must be done carefully, as it can be challenging to move from SaaS solutions to other solutions, and there are usually strict limits to customizing your solution. Despite this, smart customers are sure to focus more and more on these specialized SaaS solutions.

In terms of customized solutions, the market will certainly continue to grow in terms of money, but in the bigger picture, fully customized solutions will continue to have a very small share. From the customer's point of view, customized solutions are for situations where product solutions are not available for one's needs and there is enough money available to make a larger investment and a bigger life cycle cost.

In the future, the market for customized solutions will increasingly focus on sub-solutions, where a customized web application solves some aspects of online services, such as product comparison, product configuration, complex ordering, or even a point-to-point self-service channel. More and more offices are required to have the ability to build both product-based and customized solutions as part of the same solution. This type of approach also requires customers to do a little more pre-planning and preliminary prototyping, as well as technology choices, to be able to build the various components of their online service package with the solutions that best suit them.

Now and in the future, functional online service entities will often be built using several different pieces.

(This article has been translated from the Finnish original. Read the original article.)