We at North Patrol updated our analysis of Finnish web technologies. We analyzed the websites of 2500 different organizations, including a comprehensive sample of large corporations, online stores, public administration organizations, and associations. This first review article of this year’s survey focuses on the platforms of the main websites of these organizations.

North Patrol is a consulting firm specialized in the design of digital services and information systems. We shape ideas into a vision and service concept, find the best architectural and technological solutions, design a functional user experience, and compete to find the ideal partner for implementation work. We do not sell implementation projects, nor do we sell licenses; we are genuinely on the side of the customer.

The range of technologies is wide, but WordPress dominates the market

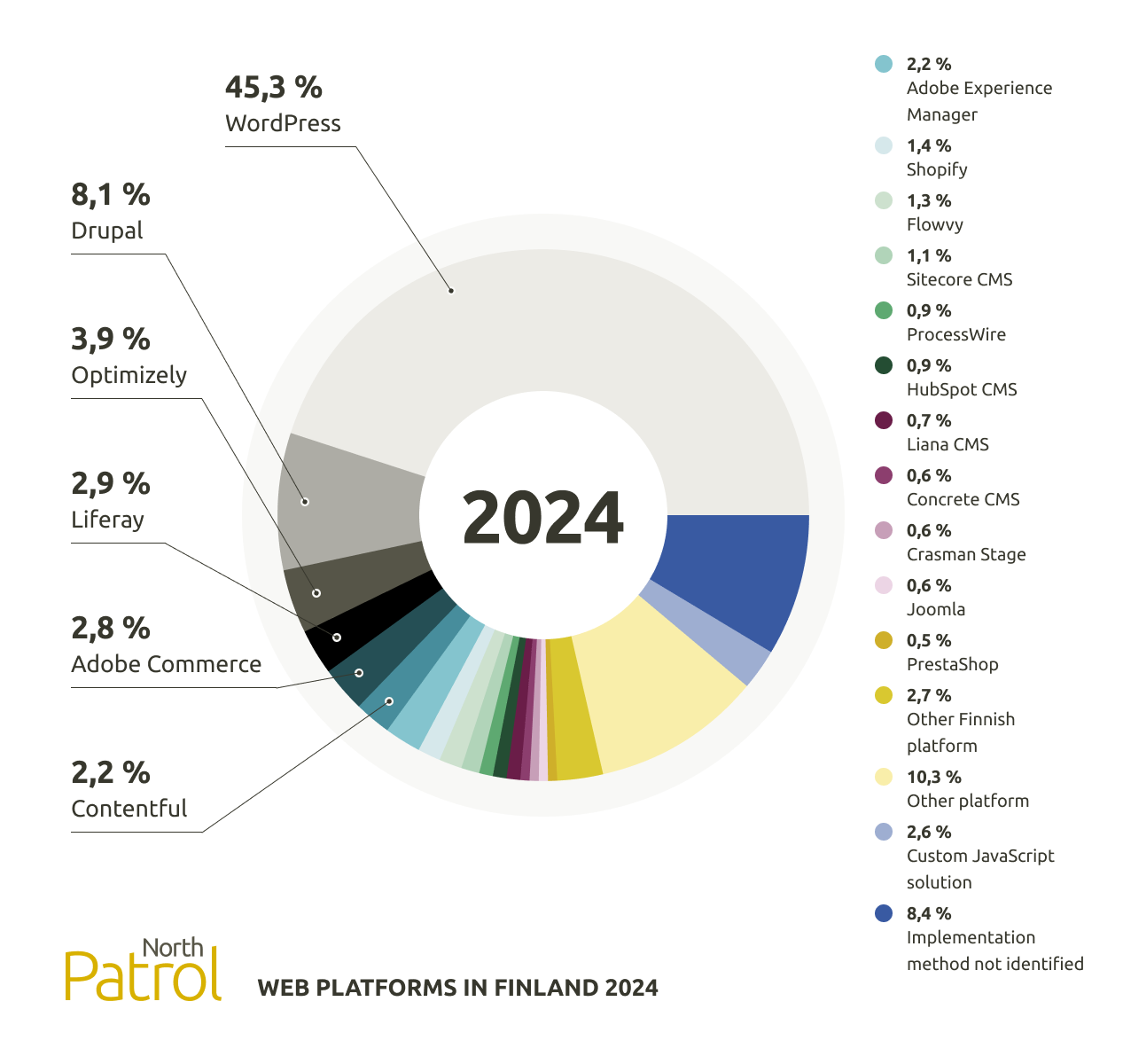

80 % of the analyzed websites were based on some form of content management system, and 9 % were based on some e-commerce product. The variety of solutions is vast, as a total of 135 different platform products were identified from 2500 websites. About 3 % of the websites were fully customized solutions. The implementation method was not identified in about 8 % of the websites.

The open-source content management system WordPress is by far the most used platform (45.3 %), and another open-source software, Drupal (8.1 %), remains the second most used platform. Following these, a long list of commercial products compete for market shares, such as Optimizely (3.9 %), Liferay (2.9 %), Adobe Commerce (2.8 %), and Contentful (2.2 %).

1. WordPress 45.3 %

WordPress is a popular open-source content management system (CMS) widely used for creating websites and blogs. Its popularity is due to its affordability, ease of use, and a broad field of suppliers and developer community.

WordPress accounts for nearly half (45.3 %) of all websites analyzed in the survey. In 2020, its share was 34 %, so its market share has increased by more than 10 percentage points over the past four years. WordPress is widely used by both private and public sector organizations, and it has also started to be used as a platform for larger sites.

Thanks to the WooCommerce extension, WordPress is also a popular platform for e-commerce, but if its share is considered solely for e-commerce sites, its market share is smaller, around 23 %.

2. Drupal 8.1 %

Drupal is another popular open-source content management system. It is known for its versatile and flexible features. It is particularly suitable for extensive and complex websites that require granular user management and customizable content types.

Drupal's market share has decreased from 9.8 % (2020) to the current 8.1 % (2024). Although its share has slightly declined, Drupal has maintained its position, especially in large, complex websites. Drupal is particularly popular as a platform for large organizations, such as major cities and university websites.

3. Optimizely 3.9 %

Optimizely (formerly Episerver) is a commercial content management system and digital experience platform (DXP). Optimizely offers a wide range of tools for managing websites and digital customer experiences. It is particularly popular among large, internationally operating companies.

Optimizely's market share has slightly declined from 5.3 % in 2020 to the current 3.9 %. This decrease is likely due to the increased prices of Optimizely's cloud version, causing some customers to seek more cost-effective platform solutions.

4. Liferay 2.9 %

Liferay is a portal and content management system that has been particularly popular among public administration organizations in Finland. Liferay's strengths include its capability for complex customer service channel solutions, although these features are used quite limitedly on Finnish Liferay sites.

Liferay's market share has decreased in recent years from 3.9 % (2020) to the current 2.9 % (2024). However, thanks to the Valtori YJA platform, it has maintained a strong position in government organizations.

5. Adobe Commerce 2.8 %

Adobe Commerce (formerly Magento) is a comprehensive and versatile e-commerce platform that offers extensive features, particularly for large and complex online stores. It is well-suited for both B2B and B2C commerce solutions.

Adobe Commerce's market share has remained relatively stable in recent years, at around 2.8 %. Its popularity is especially strong among large online stores. When considering the data solely for e-commerce, Adobe Commerce's market share is 15 %.

6. Contentful 2.2 %

Contentful is the most commonly used API-first content management system in Finland, where content is delivered to users through APIs. This platform is particularly popular among software developers and is designed to support fully customized user interface solutions.

The use of Contentful in Finland has grown significantly. In 2020, its share was only 0.4 % of websites, but by 2024 it has increased to 2.2 %.

7. Adobe Experience Manager 2.2 %

Adobe Experience Manager is a commercial DXP platform designed for extensive, multilingual websites and digital customer experience management.

Adobe Experience Manager's market share has slightly increased from 1.4 % (2020) to 2.2 % (2024). However, most Finnish Adobe Experience Manager sites belong to Finnish subsidiaries of international organizations that have adopted the group's common platform.

8. Shopify 1.4 %

Shopify is a SaaS-based (Software as a Service) e-commerce platform that offers easy-to-use tools for creating and managing online stores. Shopify is particularly popular among small and medium-sized (SME) consumer online stores due to its easy setup, quick implementation time, and scalability.

Shopify has increased its market share from 0.8 % (2020) to the current 1.4 % (2024). Its popularity has grown especially among consumer online stores. When considering the data solely for e-commerce, Shopify's market share is 8.2 %.

9. Flowvy 1.3 %

Flowvy is part of the software solution by Finnish Confirma, which integrates e-commerce, POS systems, and ERP into a single platform. It is designed specifically for the needs of SMEs, offering a flexible way to manage different sales channels on one platform.

Flowvy's share of the websites in our review has slightly decreased from 1.7 % (2020) to the current 1.3 % (2024). When considering the data solely for e-commerce, Flowvy's market share is 6.6 %.

10. Sitecore 1.1 %

Sitecore is a commercial digital experience platform (DXP) that combines content management, marketing, and analytics into one system. Sitecore is popular among large companies that require comprehensive features for multilingual sales and marketing-driven websites.

Sitecore's share of websites has slightly decreased from 1.4 % (2020) to the current 1.1 % (2024).

11. ProcessWire 0.9 %

ProcessWire is an open-source content management system that focuses on simplicity and flexibility. It provides software developers with powerful tools and interfaces for creating custom websites and is particularly suitable for projects that require tailored solutions.

ProcessWire's share has slightly increased from 0.5 % (2020) to 0.9 % (2024).

12. HubSpot 0.9 %

HubSpot is a SaaS platform that offers a wide range of tools for customer relationship management (CRM) and marketing automation. HubSpot Content Hub (formerly CMS Hub) is the content management system offered by HubSpot. It is particularly suited for SMEs that value integrated marketing automation and CRM functions in their content management workflow.

HubSpot's relatively small share of the sites in the survey can be explained by the fact that the surveyed business organizations are mostly large corporations, while HubSpot's primary user base consists mainly of smaller B2B companies.

13. Liana CMS 0.7 %

Liana CMS (formerly Sivuviidakko) is a Finnish platform that has been particularly popular among SMEs and organizations. However, the product's developer, Liana Technologies, has focused on developing digital marketing tools and has started offering WordPress-based solutions as a platform for websites. The declining market share of Liana CMS is largely due to the apparent discontinuation of new projects made with this product. The product's share of websites was 1.4 % in 2020, dropping to just 0.7 % in 2024.

14. Concrete CMS 0.6 %

Concrete CMS is an open-source content management system that offers comprehensive tools for creating and managing websites. The share of Finnish websites using Concrete CMS has been slowly declining.

15. Crasman Stage 0.6 %

Crasman Stage is a Finnish publishing system that also includes product information management features.

The share of websites using Crasman Stage as their platform has been slightly declining, and the developer, Crasman, has added other platform products to their offerings alongside their own product.

16. Joomla 0.6 %

Joomla is an open-source content management system, primarily used for smaller websites. Once very popular, Joomla's market share has been declining for a long time.

17. PrestaShop 0.5 %

PrestaShop is an open-source e-commerce platform that is particularly suitable for SMEs. PrestaShop's market share has remained relatively stable in recent years.

18. Other Finnish platforms 2.7 %

Sixteen different Finnish platform products collectively account for 2.7 % of the market. This group includes e-commerce platforms like MyCashflow and Clover Shop, as well as content management systems such as Abako Stato, Poutapilvi P4, and Tietotalo InfoWeb.

The combined market share of all Finnish platform products has decreased from 8.7 % (2020) to 5.3 % (2024). This decline reflects the intense competition with international platforms developed with larger resources.

19. Other international platforms 10.3 %

The survey identified a total of 102 other international platform products, which together make up a 10.3 % share. This group includes a diverse range of software, such as content management systems Umbraco, Typo3, and Sitefinity; SaaS website tools Squarespace and Wix; and e-commerce platforms ePages, Salesforce Commerce Cloud, SAP Commerce Cloud, and Intershop.

A certain degree of consolidation is also visible among international products, with some small market share products appearing to fade from the Finnish market. The share of the "other international platforms" group has decreased from 13.4 % (2020) to 10.3 % (2024).

20. Custom JavaScript solutions 2.6 %

2.6 % of the analyzed websites could not be identified with any specific platform technology, but their presentation layer was based on JavaScript applications. Custom solutions are best suited for complex, client-specific websites. The share of fully customized solutions among websites has remained roughly the same year after year.

The most popular application framework for custom presentation layer applications in the survey was React, which was the primary implementation technology for 1.6 % of the websites. The other two most common frameworks were Vue and Angular, each with a share of about 0.5 %.

Note: JavaScript is utilized practically on all platform-based websites as well, but in this article, websites are classified according to their primary platform.

Trends in the platform market

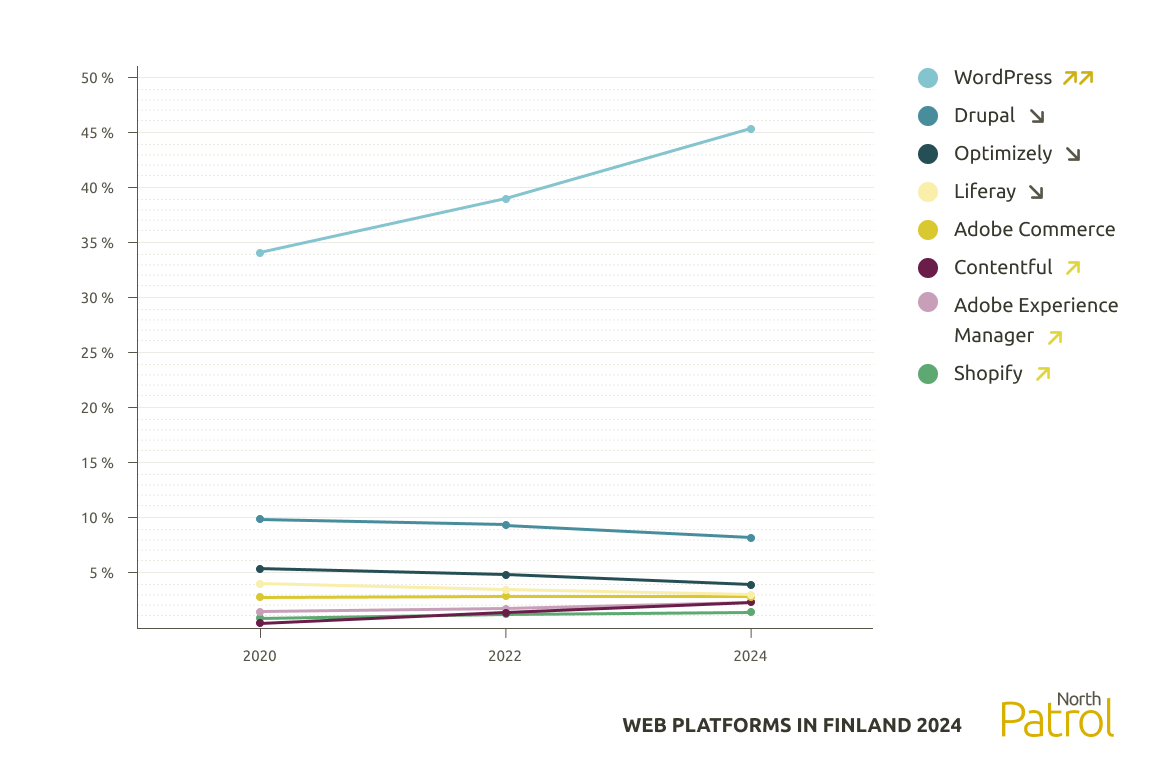

Over the past four years, the web platforms in the Finnish market have largely remained the same, but there have been significant changes in their market shares.

WordPress's position as the clearly most popular platform has strengthened. WordPress has become a fundamental tool for websites, expandable with various plugins and customizations. What was once a tool for small digital agencies has now also become part of the offerings of larger providers.

The market shares of the next most popular platforms, Drupal and Optimizely, have been slightly declining. This may partly be due to the growing popularity of WordPress in larger websites as well. Optimizely's increased price has weakened its competitiveness in the Finnish market, and it is largely becoming a platform only for the largest companies.

API-first (headless) content management systems like Contentful have significantly increased their market share, as evidenced by the multiplication of sites based on Contentful. This reflects a growing interest in flexible, developer-oriented content management solutions.

The number of fully customized websites has not grown, but a lot of customization is done on top of product platforms and in separate applications implemented alongside them. Solutions following the composable architecture combine ready-made product components and customized applications more smoothly than before. The amount of JavaScript code in the presentation layer has grown significantly over the years.

Among the large commercial content management platforms, Adobe Experience Manager has increased its market share the most, reflecting its growing popularity, especially in the shared content management solutions of international corporations. However, very few projects are still being implemented with Adobe in Finland. The trend of Finnish subsidiaries transitioning to the international group's shared platform is also evident in the data for other robust DXP platforms like Optimizely and Sitecore.

Shopify's market share has nearly doubled in the review, reflecting the growing popularity of e-commerce implemented as SaaS services and the increased number of consumer online stores. Shopify's customers likely include some who are moving away from small Finnish e-commerce products.

The combined market share of Finnish platform products has decreased from 8.7 % to 5.3 % over four years. This trend reflects growing competition with international platforms, particularly cost-effective solutions like WordPress and Shopify.

Many Finnish software companies have gradually abandoned their own platforms and switched to using more widely adopted products in their projects. In content management systems, this shift is already quite advanced. In e-commerce systems, the transition has been slower, but the trend is similar. When strong international products are available, more and more customers are choosing a more widely used platform over a Finnish one.

North Patrol assists its clients in designing software architecture, identifying alternative implementation models, and selecting the most suitable technologies. In our work, we strive to choose solutions that meet the client's requirements, are sustainable, and cost-effective. Explore our services to support your technology solutions.

How the survey was conducted?

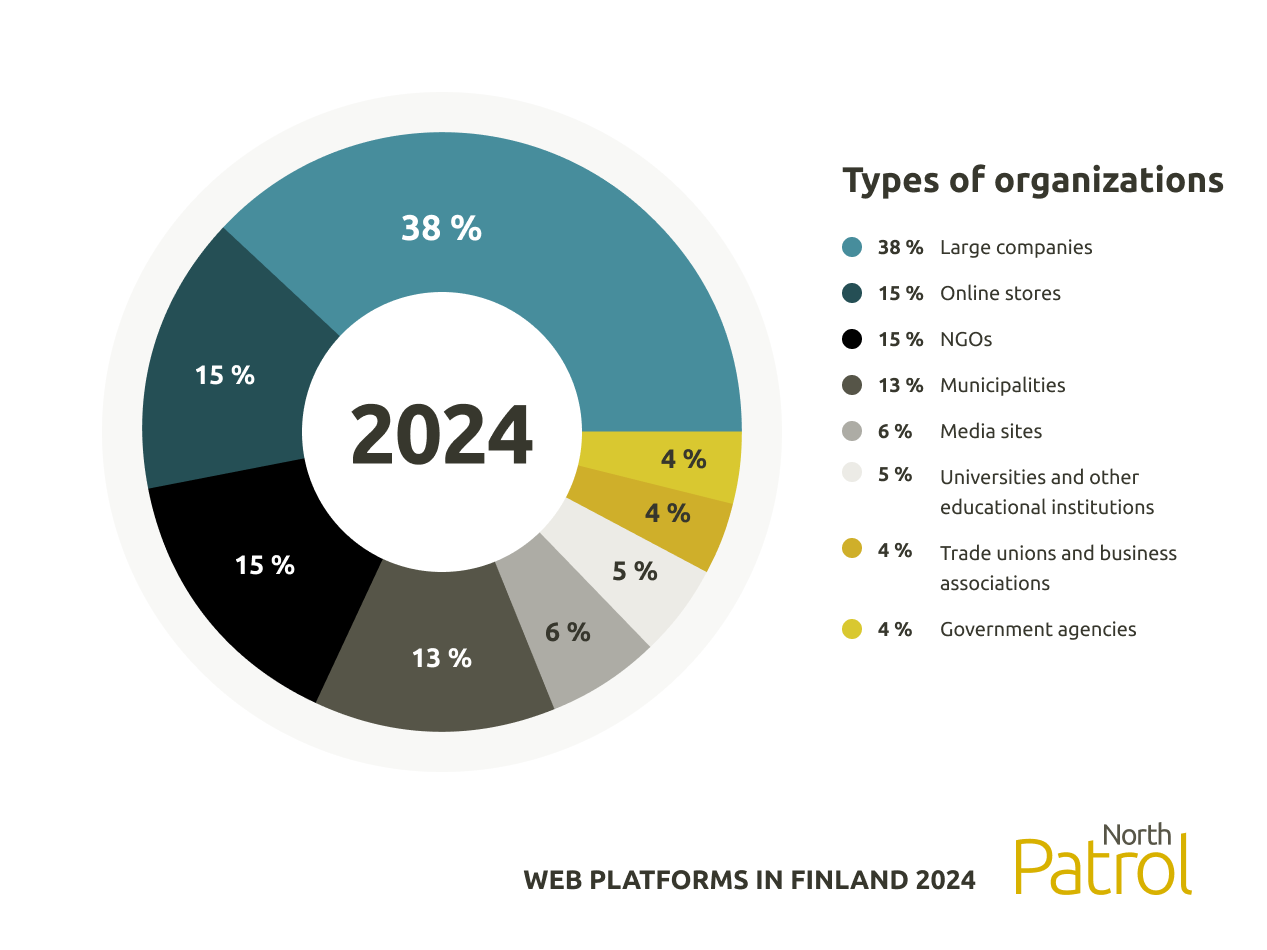

The survey included websites from 2500 different organizations. The sample comprises Finland's largest companies, online stores, and media sites from the private sector. From the public sector, the sample includes government agencies, municipalities, universities, and other major educational institutions. There was also a wide selection of websites from various organizations.

The organizations in the sample were divided into the following categories:

The technology analysis utilized the paid API of the commercial BuiltWith service, which provided analysis for all the sites in the sample. Additionally, accuracy was enhanced with analyses from other technology trackers and manual analysis conducted by North Patrol's experts.

For this article, the main websites of each organization or brand were reviewed to identify the main technologies they use. The primary principle was to include only one site per organization. Thus, this article's analysis of website platforms did not extend to the technologies used by the subdomains of the organizations.

North Patrol Oy, which conducted the survey, is an independent expert company free from IT vendors and technologies. It helps clients design information systems and tender implementation partners. The survey is funded and carried out by North Patrol itself.