North Patrol analysed all public IT procurement contracts made in 2023. We analysed and categorised the data based on the subject of procurement, the contracting organisation, the contract value, and the selected suppliers. At the same time, we assessed how genuine and transparent the competition in public IT procurement is.

North Patrol is a consulting firm specialized in the design of digital services and information systems. We shape ideas into a vision and service concept, find the best architectural and technological solutions, design a functional user experience, and compete to find the ideal partner for implementation work. We do not sell implementation projects, nor do we sell licenses; we are genuinely on the side of the customer.

This report follows on from the earlier data review on public procurement notices and requests for participation related to IT procurements in 2023.

The data review reviewed all 5970 contract award notices of public procurement published in the Hilma service in 2023. From the data, 793 contract award notices related to IT procurements were selected for a more detailed analysis based on the CPV codes describing the subject matter of the procurement.

The total value of the reported IT procurement contracts was 1.6 billion euros. The data provided a good overview of the largest IT contracts undertaken by the public sector and procurement done within dynamic purchasing systems in 2023.

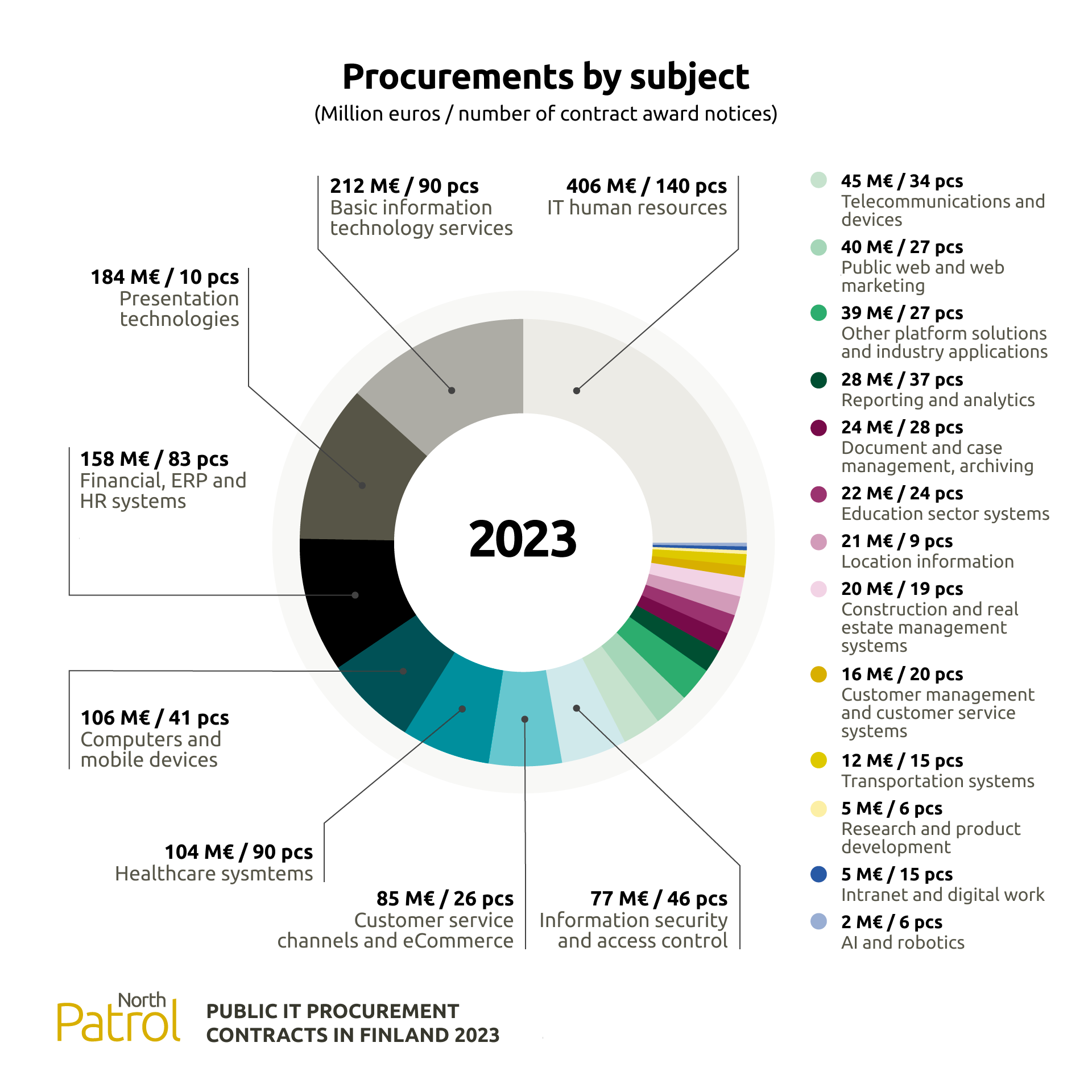

Personnel resourcing procurement is the largest focus in IT procurement

Because the CPV classification used in public procurement does not provide an accurate information of the purpose of the procurement, the subjects of the contracts were manually classified by North Patrol's experts. Based on that classification, it can be seen that public IT procurement is carried out for a wide range of very different needs.

The largest subject area of the procurement contracts is IT human resources for a total value of more than 406 million euros (25 % of the value of the procurements). Procurement was the object of the work to be purchased and was not precisely defined or classified in this category. This procurement included extensive framework agreements for IT human resources and smaller rental-type procurement. In practice, the procurement of human resources is a much wider phenomenon in public procurement, as other subjects also included a large number of purchases, which were in practice organised as the purchase of human resources.

The second larges subject of procurement was various basic information technology services, which were purchased for 212 million euros (13 % of the value of the procurements). This procurement included a wide range of near-support, system and service management and related expert services, as well as software and system procurement in basic information technology.

The third largest subject area was presentation technology and other office space systems, for which the value of the contracts amounted to 184 million euros (11 % of the purchase value). The large proportion of this subject in 2023 is mainly because of one large framework agreement for presentation technology by Hansel.

The fourth larges area of procurement is economic and operational management and HR systems, for which the value of the contracts amounted to 158 million euros (10 % of the purchase value). These system acquisitions range from the implementation of ready-made software to highly tailored customer-specific solutions.

The fifth most valuable subject area was procurement contracts for computers and mobile devices, with a value of 106 million euros (7 % of the value of the procurement).

Systems for social services and healthcare were the sixth most valuable subject area, with a total value of 104 million euros (6 % of the value of the procurement). The larger size of IT procurement in the healthcare sector is largely explained by the procurement related to the launch of new welfare areas.

Central purchasing bodies and the government procure the most

The share of various central purchasing bodies, in-house companies and similarly centralised service units in public IT procurement has increased steadily. The value of the contracts made by the central purchasing bodies in 2023 was approximately 450 million euros (28 % of the value of IT procurement). The procurement contracts of the central purchasing bodies highlight equipment procurement and basic information technology services, but a significant amount of human resources and financial management systems are also procured through them.

The central government carries out the majority of public IT procurements, and although the role of central purchasing bodies has grown, most of the government's IT purchases continue to take place as organisations' own competitive bidding. The value of IT contracts made by the central government, state institutions and other state units (excluding contracts for joint procurement units) amounted to approximately 700 million euros (about 43 % of the total value of procurement). By far the largest individual target in the central government's IT procurement was the purchase of human resources for various projects.

Other public administration organisations also make a large amount of IT procurement, but the average monetary value of the contracts they make is lower than those of central purchasing bodies or the central government. The value of the IT contracts published by municipalities and joint municipal authority was 225 million euros (14 % of the value of procurement), and of the contracts signed by welfare areas and other social welfare organisations amounted to 130 million euros (8 % of the value of the procurement). The total value of IT procurement by universities and other educational institutions was 59 million euros (4 % of the value of the procurement).

The organisations with the most procurements (top 25)

The following table lists the organisations that made the most IT procurements in 2023 (over 15 million euros in total). The table shows the number of contract award notices made by the organisations, the aggregate value of the contracts and the average number of tenders received by the organisation for the procurement for which this information was available in the contract award notices.

| # | Organisation | Number of contract award notices | Value of contracts | Number of tenders (average) |

|---|---|---|---|---|

| 1 | Hansel Oy | 4 | 178 M€ | 5 |

| 2 | Tax Administration | 9 | 171 M€ | 11 |

| 3 | Helsingin Seudun Liikenne (HSL) | 4 | 123 M€ | 16 |

| 4 | Kela | 95 | 96 M€ | 6 |

| 5 | Veikkaus Oy | 14 | 93 M€ | 3 |

| 6 | Puolustusvoimien logistiikkalaitos | 10 | 81 M€ | 4 |

| 7 | Valtion tieto- ja viestintätekniikkakeskus Valtori | 15 | 76 M€ | 4 |

| 8 | Kuntien Tiera Oy | 22 | 74 M€ | 3 |

| 9 | Monetra Oulu Oy | 3 | 69 M€ | 4 |

| 10 | DigiFinland Oy | 9 | 40 M€ | 6 |

| 11 | Meidän IT ja talous Oy | 7 | 37 M€ | 3 |

| 12 | Oikeusrekisterikeskus | 14 | 34 M€ | 4 |

| 13 | Business Finland Oy | 5 | 33 M€ | 7 |

| 14 | Istekki Oy | 20 | 32 M€ | 2 |

| 15 | HUS-yhtymä | 15 | 31 M€ | 3 |

| 16 | Länsi-Uudenmaan hyvinvointialue | 4 | 26 M€ | 1 |

| 17 | Väylävirasto | 15 | 23 M€ | 3 |

| 18 | City of Helsinki | 12 | 18 M€ | 3 |

| 19 | Patentti- ja rekisterihallitus | 5 | 18 M€ | 3 |

| 20 | Keva | 5 | 17 M€ | 9 |

| 21 | City of Hämeenlinna | 6 | 17 M€ | 4 |

| 22 | Yleisradio Oy | 16 | 17 M€ | 4 |

| 23 | Fingrid Oyj | 6 | 15 M€ | 2 |

| 24 | Pohjois-Pohjanmaan hyvinvointialue | 12 | 15 M€ | 4 |

| 25 | City of Tampere | 7 | 15 M€ | 16 |

In 2023, the contents and procurement procedures of the five organisations that made the most procurements differed significantly from each other: Hansel purchased equipment and services for the use of others by means of framework contacts, the tax administration and HSL purchased IT personnel resources for their own use through framework arrangements, while Kela purchased the human resources they needed through a DPS arrangement. On the other hand, the majority of Veikkaus' procurements occurred as more clearly limited system procurements.

Of Hansel's four (4) purchases, the majority (in euros) are related to two broad framework arrangements (contracts worth 169 million euros and 8.4 million euros) in which Hansel, as a central purchasing body, purchases equipment and services for the use of its customer organisations. The total euro share of the two procurements made by Hansel for its own use is very small.

Of the nine IT procurements made by the tax administration, the largest share (in euros) is related to the establishment of one comprehensive framework arrangement for expert services (with a value of 150 million euros). The framework agreement provides for the procurement of human resources, programming, testing and management of systems from suppliers selected for the framework arrangement.

Of the value of the four IT procurements announced by the Helsingin Seudun Liikenne (HSL) community, the majority is related to the establishment of two broad framework arrangements for expert services (value of the contracts 104 million euros and 15 million euros). Through the framework agreements, human resources in the areas of software development, maintenance and cybersecurity are acquired for HSL from a wide range of suppliers selected for the frameworks agreement.

In 2023, the social insurance institution of Finland (Kela) made as many as 95 contract award notices concerning IT procurement. 66 of the announced purchases (total value of 60 million euros) were made through Kela's own dynamic procurement system for IT specialist services (DPS), and they concerned human resources for the development of Kela's various systems. Furthermore, Kela acquired various information systems and basic information technology services as separate procurements.

Veikkaus made 14 contract award notices. The share of the acquisition of two online casino games in Veikkaus' IT procurements amounted to 57.5 million euros, which was more than 60 % of their total IT procurements. Furthermore, the company made an acquisition of 12.5 million euros for an operational management system. In addition to system purchase, Veikkaus also made human resource purchases through both Hansel's DPS arrangements and its own framework agreements.

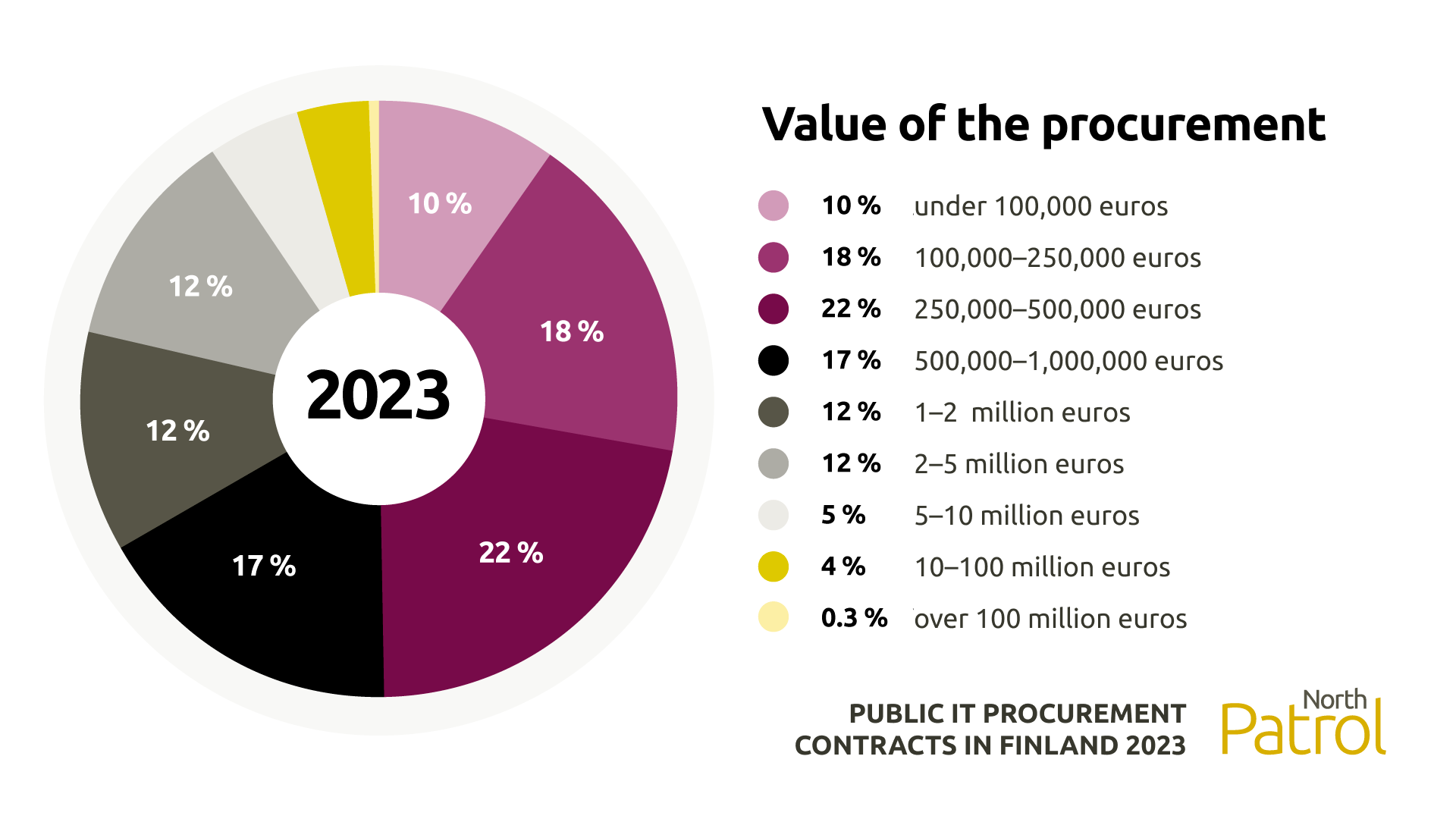

The median value of IT contracts is €500,000

The value of the procurement was stated in 640 contract award notices of 2023. The total value of the announced IT procurement contracts was EUR 1.6 billion.

The value of procurement had decreased since 2022, when the total value of the procurement was 2.2 billion euros. The higher amount in 2022 is explained by two exceptionally large procurements with a combined amount of almost 1 billion euros.

The variation between the value of contracts were very wide. The median value of the contracts in 2023 was 500,000 euros, with an average of 2.6 million euros. The largest procurement was 169 million euros, while the smallest procurement was 4,000 euros.

The average value of procurement costs is significantly increased by the largest procurements, most of which were different framework arrangements. The average value of the 20 largest procurements was 42.6 million euros, and their combined share of the value of all procurements was approximately 50 %. If the top 20 is ignored, the average value of the other procurements is 1.4 million euros.

Procurements related to information systems are typically for rather long periods of time and the declared costs are divided over the entire contract period, which in the public administration is typically four years.

The prices indicated in the contract award notices are estimates of the value of the contract at the signing stage. It is not uncommon for procurement budgets to be exceeded or contracts to be renewed after the first contract period. The realised amounts for the winning companies may therefore be greater than those stated in the contract award notice. The budget for the procurement can also, of course, be reduced downwards during the contract period due to future savings in the public administration, for example.

The biggest IT procurement contracts (top 20)

The following table lists the 20 largest IT procurement contracts in 2023 (acquisitions of at least 13 million euros).

| # | Organisation and the subject of the procurement | Procurement value | Number of offers | Chosen suppliers |

|---|---|---|---|---|

| 1 | Hansel Oy Esitystekniikan laitteet ja palvelut 2023-2026 (2027) (Frame agreement) | 169 M€ | 9 | Advania Finland Oy, Atea Finland Oy, Dustin Finland Oy, Caverion Suomi Oy, Lyreco Finland Oy |

| 2 | Tax Administration IT-asiantuntijapalvelujen hankinta (Frame agreement) | 150 M€ | 35 | Siili Solutions Oyj, Tietoevry Finland Oy, Zure Oy, Gofore Lead Oy, Nordcloud, Fujitsu Finland Oy, Gofore Oyj, Gofore Verify Oy, Futurice Oy, Knowit Solutions Oy, Alfame Systems Oy, CGI Suomi Oy |

| 3 | Helsingin Seudun Liikenne (HSL) Ohjelmistokehityksen ja -ylläpidon asiantuntijapalvelut (Frame agreement) | 104 M€ | 34 | Fujitsu Finland Oy, Visma Consulting Oy, Twoday Oy, Digia Finland Oy, Unikie Oy, Oy IBM Finland Ab, Nordcloud Oy, EY Advisory Oy |

| 4 | Monetra Oulu Oy Taloushallinnon järjestelmäkokonaisuus SaaS-palveluna | 52 M€ | 3 | Abilita Oy Ab |

| 5 | Veikkaus Oy Live Casino Games Framework Agreement (Frame agreement) | 50 M€ | 3 | Playtech Software Limited (GB) |

| 6 | Puolustusvoimien logistiikkalaitos Luokka1 - Tietokoneet 2021-2025 (DPS internal procurement) | 40 M€ | 3 | Dustin Finland Oy |

| 7 | Valtion tieto- ja viestintätekniikkakeskus Valtori Oracle -käyttöoikeuksien jakelu- ja hallintapalvelu sekä siihen liittyvät tuki-, asiantuntija-, koulutus- ja ylläpitopalvelut (Frame agreement) | 38 M€ | 3 | Advania Finland Oy |

| 8 | Business Finland Oy Digitaalinen palvelukehitys ja ylläpito (Frame agreement) | 32 M€ | 14 | Accenture Oy, Tietoevry Finland Oy, CGI Suomi Oy, Twoday Oy, Solita Oy, Capgemini Finland Oy, Q-Factory Oy |

| 9 | Meidän IT ja talous Oy Talous- ja henkilöstöhallinnon järjestelmät | 30 M€ | 2 | Visma Public Oy |

| 10 | Kuntien Tiera Oy Tiera 365 - Microsoft CSP-tuotteet sekä niihin liittyvät tukipalvelut | 25 M€ | 2 | ALSO Finland Oy |

| 11 | Länsi-Uudenmaan hyvinvointialue ICT-asiantuntijakonsultointipalvelujen hankinta (Frame agreement) | 25 M€ | No info | Gofore Lead Oy, Amagi Oy, Accenture Oy, Deloitte Consulting Oy, Solita Oy |

| 12 | DigiFinland Oy ICT-alustapalveluiden hankinta (Frame agreement) | 21 M€ | 5 | Tietoevry Tech Services Finland Oy |

| 13 | City of Hämeenlinna Kanta-Hämeen tietoliikennepalvelut (Frame agreement) | 16 M€ | No info | Telia Finland Oyj, Lounea Yritysratkaisut Oy |

| 14 | Tax Administration Turvallisuuden ja riskienhallinnan asiantuntijapalvelujen hankinta 2023 (Frame agreement) | 16 M€ | 16 | Gofore Verify Oy, Digia Finland Oy, CGI Suomi Oy, KPMG Oy Ab, WithSecure Oyj, Nixu Oyj, Deloitte Oy, Accenture, Frontline Responses Finland Oy, Seclion Oy, Asianajotoimisto Bird & Bird Oy |

| 15 | Helsingin Seudun Liikenne (HSL) Kyberturvallisuuden asiantuntijapalveluiden hankinta (Frame agreement) | 15 M€ | 8 | Capgemini Finland Oy, Consultor Finland Oy, Digia Finland Oy, Nordcloud Oy, Solita Oy, WithSecure Cyber Security Services Oy, KPMG Oy Ab, Deloitte Oy |

| 16 | Veikkaus Oy Testaus- ja laadunvarmistuksen palvelut (Frame agreement) | 15 M€ | 6 | Symbio Finland Oy, VALA Group Oy, Q-Factory Oy, Nextcon Finland Oy, Knowit Solutions Oy |

| 17 | Kuntien Tiera Oy Tiera 365 -asiantuntijapalvelut (Kori 4 - Microsoft Dynamics 365: CRM (Customer Relationship Management) ja Power Platform) | 15 M€ | 2 | Digia Finland Oy, Innofactor Software Oy |

| 18 | Monetra Oulu Oy Sosiaali- ja terveyspalveluiden kustannuslaskentajärjestelmän hankinta | 15 M€ | No info | Logex Oy |

| 19 | City of Tampere ICT-asiantuntijapalvelut (Frame agreement) | 14 M€ | 74 | Atea Finland Oy, CGI Suomi Oy, Citrus Solutions Oy, Deloitte Consulting Oy, Digia Finland Oy, Futurice Oy, Gofore Oyj, Huld Oy, KPMG Oy, Netum Oy, Nordcloud Oy, North Patrol Oy, Sofigate Oy, Solita Oy, Ubigu Oy, Ambientia Oy, Capgemini Finland Oy, Knowit Solutions Oy, Loihde Analytics Oy, Pinja Digital Oy, Ready Solutions Oy, Siili Solutions Oyj, Twoday Oy, Witted Megacorp Oyj, Brightly Works Oy, Innofactor Software Oy, Kipinä Software Oy, Sulava Oy, Thoughtworks Finland Oy, Zure Oy, Cinia Oy, KPMG Oy Ab, Second Nature Security Oy, Tietoevry Connect Finland Oy, Nortal Oy, Vincit Oyj, Codemen Oy, Kumura Oy, Notkia IT Oy, Unikie Oy, Vuolu Group Oy, Alfame Systems Oy, Atostek Oy, Nordcloud Oy), Fujitsu Finland Oy, Q- Factory Oy, Sitowise Oy, Testimate Oy, VALA Group Oy, ADE Oy, Kuubi Oy, Midnight Forge Oy, MEKIWI Oy, Stereoscape Oy, ThingLink Oy, Zoan Oy, Anders Innovations Oy, Buutti Oy, Cloudriven Oy, Druid Oy, Lease Deal IT Oy, Teamit Group Oy |

| 20 | Veikkaus Oy Veikkaus toiminnanohjausjärjestelmä: toteutus ja ylläpito | 13 M€ | 1 | Accenture Oy |

IT procurements have 394 different suppliers

The selected supplier or suppliers were named in 647 contract award notices. A total of 394 different supplier organisations were selected for IT contracts, which is a fairly large number of companies.

In approximately 90 percent of the tenderings one supplier was selected, and in about 10 percent two or more suppliers were selected. The average number of suppliers in all procurements was 1.4 suppliers per procurement.

In the case of multi-supplier framework contracts, a supplier receiving an order is selected only by, for example, an internal competition or by order of priority in the framework contract. Access to the framework arrangement does not necessarily guarantee that the supplier can do billable work within the framework of the contract.

The majority of the contractors were companies operating in Finland. To some extent, public procurement seems to be concentrated on specific suppliers, but no individual supplier has a superior position in the public administration IT market in terms of the number of contracts. Gofore, Tietoevry, CGI and Visma were the suppliers that won the most contracts.

Among the larges procurements were many framework contracts for which several suppliers were selected. A total of 91 different suppliers were selected for the 20 largest procurements. The number of suppliers was significantly increased by the framework agreement for ICT specialist services of the city of Tampere, in which 62 different providers were selected. If Tampere is excluded, a total of 51 different suppliers were selected for the other top 20 procurements.

Among the suppliers for the 20 largest procurements, the most frequently recurring companies/groups were Gofore, Visma, Nordcloud, Digia, Deloitte, CGI, Solita, KPMG and Tietoevry.

The suppliers which received the most contracts (top 21)

The following table consists of a list of suppliers that received the highest number of public IT procurement contracts according to contract award notices in 2023 (9 or more contracts).

| # | Supplier | Number of contracts |

|---|---|---|

| 1 | Gofore (and the associated organisations) | 34 |

| 2 | Tietoevry Finland (and the associated organisations) | 33 |

| 3 | CGI Suomi | 31 |

| 4 | Visma concern organisations, Twoday and Visma Public among others | 27 |

| 5 | Siili Solutions | 17 |

| 6 | Fujitsu Finland | 16 |

| 7 | Ambientia | 15 |

| 8 | Digia Finland | 15 |

| 9 | Solita | 14 |

| 10 | Elisa (and the associated organisations) | 14 |

| 11 | Advania Finland (and the associated organisations) | 14 |

| 12 | Accenture | 13 |

| 13 | Atea Finland | 13 |

| 14 | Netum | 13 |

| 15 | KPMG | 13 |

| 16 | Nordcloud | 12 |

| 17 | Sofigate | 11 |

| 18 | Dustin Finland | 11 |

| 19 | Consultor Finland | 11 |

| 20 | Innofactor (and the associated organisations) | 9 |

| 21 | Deloitte (and the associated organisations) | 9 |

The value of contracts is distributed unevenly among suppliers

Based on contract award notices, it is possible to estimate not only the number of contracts but also the total value of supplier-specific contracts. This is straightforward in the case of procurements by a single supplier, but it is difficult to estimate how procurements will be distributed between different suppliers in multi-supplier framework agreements.

However, the value of the contracts can be roughly estimated by dividing the value of the framework contracts equally among the selected suppliers (although in reality the procurement is unequally distributed among the different suppliers). Calculating it like this, there were 36 supplier organisations worth over 10 million euros, and about 150 IT suppliers worth over one million euros, when a total of 394 suppliers were selected for procurement.

The combined share of the ten largest suppliers in the announced procurement value was approximately 40 %. The combined share of the 20 biggest suppliers was about 57 % of the value, and the combined share of the 50 largest suppliers was about 79 %. The nearly 350 other selected suppliers outside the top 50 will only be able to share approximately 21 % of the value of all IT procurement.

Although there are a large number of suppliers, large procurements are concentrated on a small number of larger sized suppliers. The concentration of large procurements can be considered to be a problem in terms of open competition, in particular with regard to the opportunities for small and medium-sized suppliers. The concentration on larger sized suppliers has been driven especially by large framework agreements that favour these larger suppliers. Small companies often find it difficult to access large-scale framework contracts, for example due to strict reference requirements or the required large number of employees, even if they have excellent expertise in the subject of the procurement.

The largest suppliers in terms of contract value (top 20)

Based on the calculated value of the announced contracts, the following table lists the 20 largest public administration suppliers in 2023. Each supplier includes the main topics of their contracts. Access to the list required the calculated total value of the contracts to be between 20 and 100 million euros.

| # | Supplier | The main subject area of the procurement |

|---|---|---|

| 1 | Dustin Finland | Computers, mobile devices, presentation technology systems |

| 2 | Tietoevry concern | IT human resources, basic information technology services, information systems, for example, for the social and healthcare sector |

| 3 | Visma concern | IT human resources, information systems for example for the financial management sector |

| 4 | Advania concern | Basic information technology services, production of hardware |

| 5 | Gofore concern | IT human resources |

| 6 | Abilita | Systems for financial management |

| 7 | Atea Finland | Basic information technology services, production of hardware, communication systems |

| 8 | Playtech Software Limited (GB) | Online casino game system for Veikkaus |

| 9 | Digia Finland | IT human resources, information systems |

| 10 | Accenture | IT human resources, information systems |

| 11 | CGI Suomi | IT human resources, basic information technology services, information systems |

| 12 | Nordcloud | IT human resources, basic information technology services |

| 13 | Caverion Suomi | Property systems |

| 14 | Lyreco Finland | Presentation technology systems |

| 15 | Fujitsu Finland | IT human resources, information systems, basic information technology services |

| 16 | Siili Solutions | IT human resources |

| 17 | Solita | IT human resources |

| 18 | Ambientia | IT human resources, transaction services |

| 19 | ALSO Finland | Tiera 365: Microsoft CSP products and relating support services |

| 20 | IBM Finland | Basic information technology services, IT human resources |

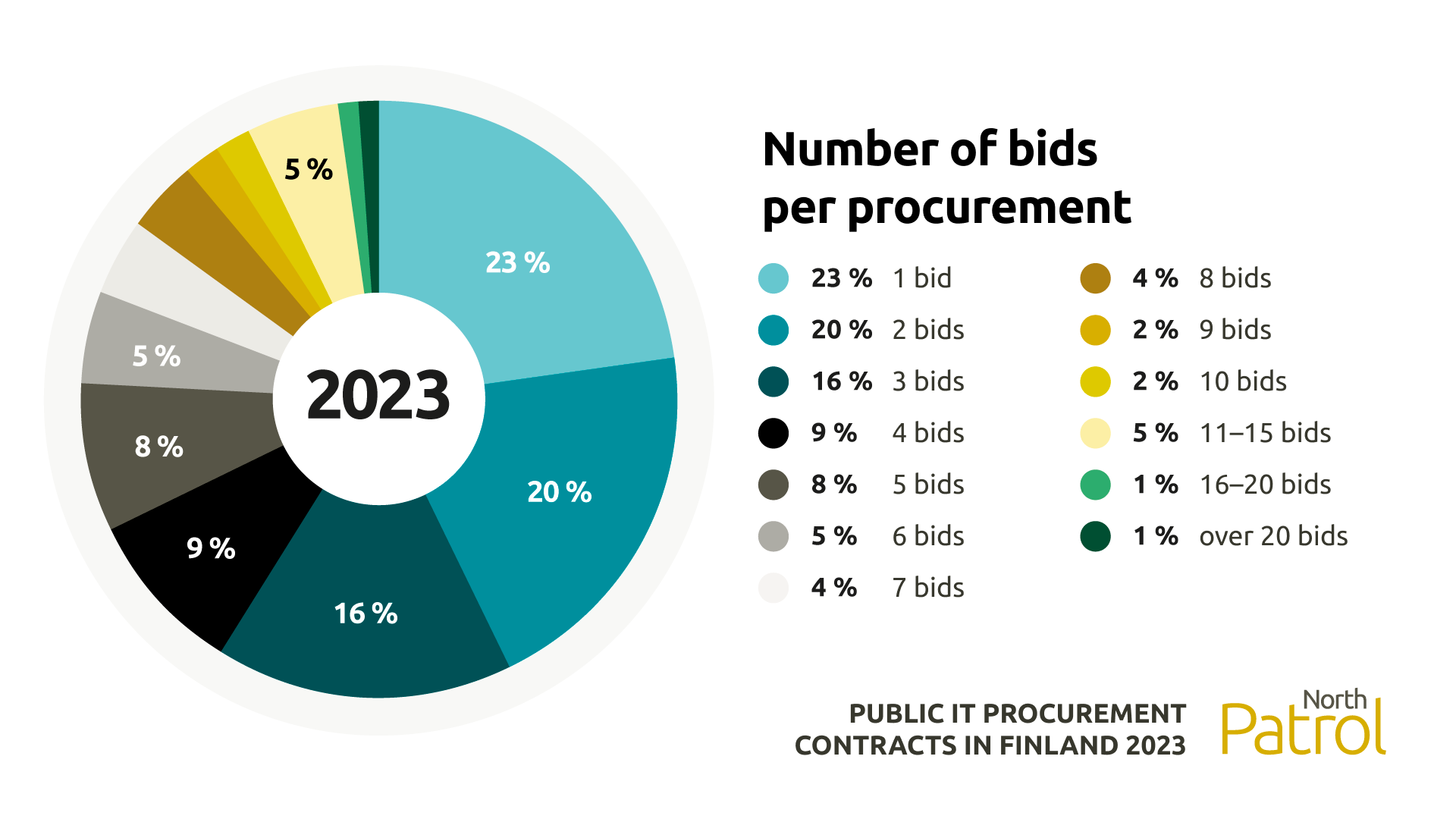

The median number of bids is 3 per tender

The number of bids submitted in the tendering process was announced in 511 contract award notices. The average number of offers was 4.4 per tender. The median of the offers received was 3 bids per tender.

In 23 % of the procurements, only one offer was received. In 20 % of the procurements, only two offers were received and in 16 % of procurements 3 offers were received. In total, almost 60 percent of IT procurements were resolved in competitive tendering with a maximum of three offers.

In the highest-value procurements, supplier interest in making an offer was significantly higher than average and the number of offers received was higher. Nevertheless, almost half of the largest procurements were settled through competitive tendering with a maximum of three bidders.

The small number of bids is a problem for the functionality of competitive tendering. It is generally estimated that there should be at least five bids in order to implement the principle of good competition.

The number of bids does not appear to have a strong statistical correlation with the subject of the procurement or the type of contracting entity, but rather very similar tenders may result in a very different number of bids depending on the implementation of the tenders.

There were some individual organisations in the data, all of which received very few bids for their tenders. With regard to these organisations, it should be considered whether their conscious aim was to direct procurement to certain suppliers, or whether their procurements have been too difficult to create genuine competition for other reasons.

Although the number of bids in IT tenders can still be considered too small, the situation has been improving. The number of bids for tenders has increased significantly since 2022, with an average of 3.1 bids per tender and a median of 2 bids for each tender. In the data for 2022, there were also significantly more tenders which had received only one offer. Such cases accounted for as much as 31 % of contract award notices in 2022.

The increase in offers is mainly due to the tightening of the market situation for IT services. The increase in competition encourages IT suppliers to participate more actively in public administration procurement.

Note: The figures describing the number of bids have only taken into account those procurements for which the information on the amount of offers has been available. Therefore, there are no procurements in which no offers have been received at all, which have been suspended for some other reason, or in which the number of bidders has not been announced to Hilma. The figures do not include the contract award notices made by Hilma's new eForms notifications at the end of 2023, which no longer contain information on the number of bidders. In the coming years, the transparency of public procurement will be significantly reduced, as information on the number of offers is no longer openly available due to changes in Hilma.

The average amoung of offers received in the public IT procurements consulted by North Patrol in 2023 was 7.9 and the median amount was 7 bids. North Patrol pays a lot of attention in the preparation of tenders to ensure that as many offers as possible have an equal opportunity to participate in the process of tendering.

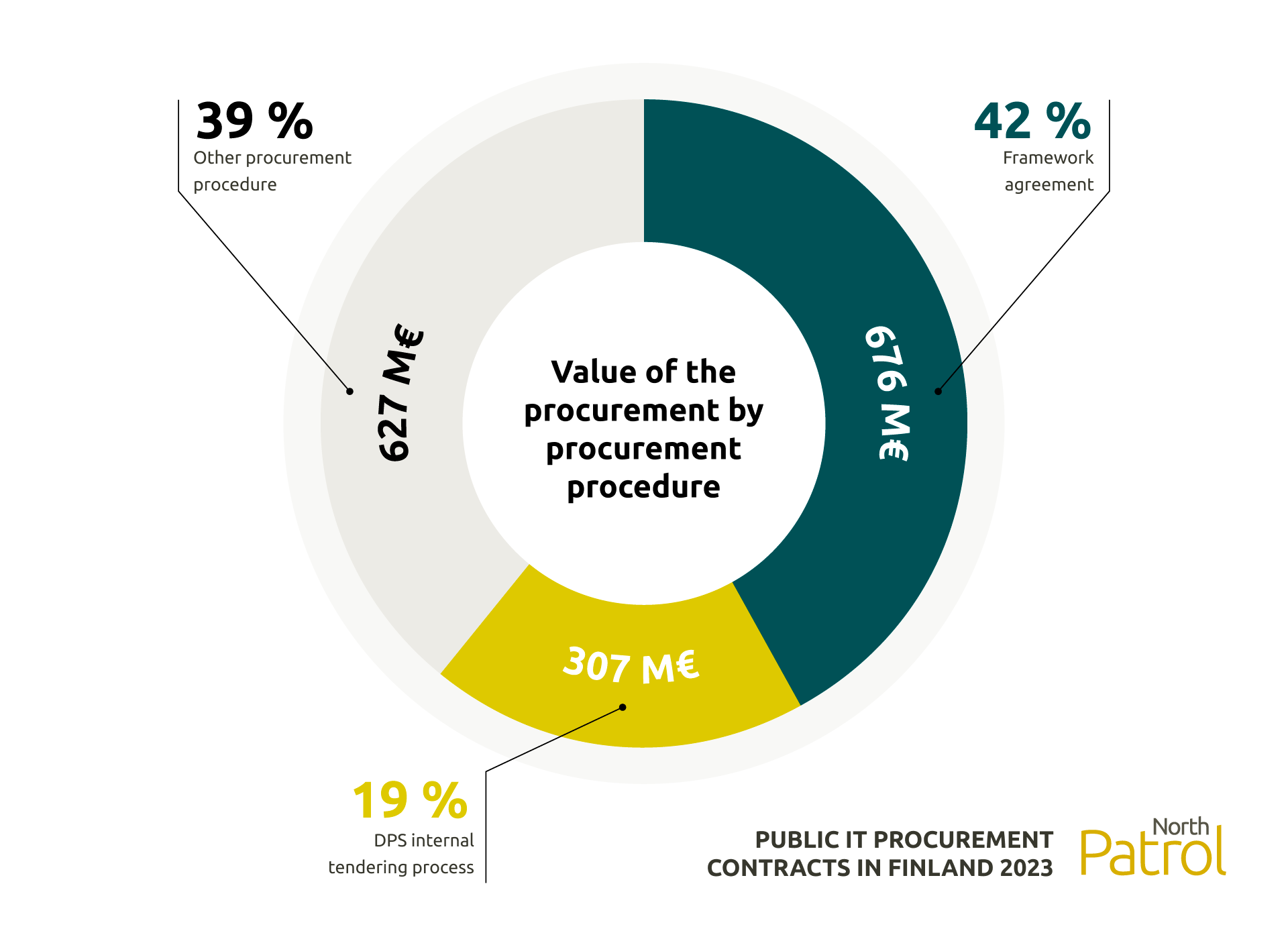

Framework arrangements weaken the transparency of public procurement

The transparency of public IT procurements is largely dependent on the procedure used in the procurement. The majority of public-sector information system procurements take place through various framework contracts and dynamic purchasing systems (DPS), which contribute to reducing the transparency of the procurement process.

A 42 % share of the value of public IT procurements comes through framework arrangements, i.e. 676 million euros. Public procurement and contract award notices concerning framework contracts are made only when the framework agreement is established, and there is no more detailed information available of what types of procurement has been made within the framework agreements during the contract period.

The majority of the larger framework arrangements are multi-supplier arrangements. These accounted for 33 % or 533 million euros of the value of all procurements. In the case of such arrangements, there is no public information available about which supplier the procurement will ultimately be made with.

Procurement through dynamic procurement systems accounted for 19 % of the value of the procurement, or 307 million euros. DPS arrangements have the same problems in terms of procurement transparency as framework arrangements, as internal bidding calls are only visible to the suppliers involved. However, DPS is a more transparent procedure than the framework agreement in the sense that contract award notices must be made for procurements within the framework of DPS. The requirements for participation in DPS arrangements are also generally lower than in framework arrangements and may also include new suppliers during the contract period.

The share of other procurements, essentially tenders obtained through direct tendering processes, accounted for 39 % of the total value of procurement, totaling 627 million euros. Direct IT tenders by public sector organisations are the most transparent procurement type, as the subject of procurement, the value of the procurement, and the selected supplier are publicly visible in the contract award notice.

The share of procurement contracts made by central procurement units and and other centralised service units amounted to 454 million euros (28 % of the total value of procurement). Regardless of the procurement model, a common issue with procurement conducted by central procurement units is often the lack of transparency, as it is not always openly visible which public sector organisation will ultimately utilise (and pay for) the procurement.

The numerical share of framework agreements and DPS in public IT procurement notices has not significantly increased in recent years. According to North Patrol's surveys from 2020 to 2023, the share of framework agreements in the total number of procurement notices has ranged from 10 % to 13 %, while the share of DPS arrangements has been between 2 % and 3 %.

However, the monetary size of framework agreements and DPS arrangements has significantly increased, meaning that an increasingly larger portion of public procurement euros are being spent within these arrangements. It is naturally concerning from the transparency perspective of procurement that an ever-growing portion of the value of IT procurement contracts is being determined through non-open tendering.

The study regarding procurement notices for the year 2023 seems to anticipate the continuation of this trend, particularly the increasing significance of DPS arrangements. According to the procurement notices analysed in the study, DPS arrangements would represent a staggering 73 % of the monetary value of upcoming IT procurements, while framework agreements would constitute 13 %, and all other procurements only 14 %.

More information on the implementation of this review

The survey covered all public contract award notices related to information systems, ICT services, and hardware production published in 2023. This study is a continuation of North Patrol's previous data review of public tender notices and requests for participation in IT procurement, as well as a study on contract award notices from 2022.

The contract award notice data reviewed in this article was collected using the open interfaces of the HILMA service. Contract award notices related to IT tenders have been filtered according to CPV classifications, similar to previous public procurement data overviews conducted by North Patrol. North Patrol has analysed and categorised the data regarding the perspectives covered in the report.

The data used in the study provides a good overview of the largest IT contracts made by the public sector and procurements conducted within DPS arrangements. However, some of the contract award notices lack sufficient information, and the dataset completely omits procurements for which the contracting authority has, for one reason or another, failed to submit a mandatory contract award notice. Additionally, the dataset does not include smaller IT procurements that fall below the EU threshold, for which contracting authorities are not obligated to submit a contract award notice.

North Patrol is an independent expert company in the field of IT suppliers and technologies, assisting clients in designing information systems and selecting implementation partners through tender processes. North Patrol has had a significant consulting role in approximately two percent of the tendering processes or project preparations covered in this study. Additionally, North Patrol has undertaken smaller assignments for tens of public sector organisations.