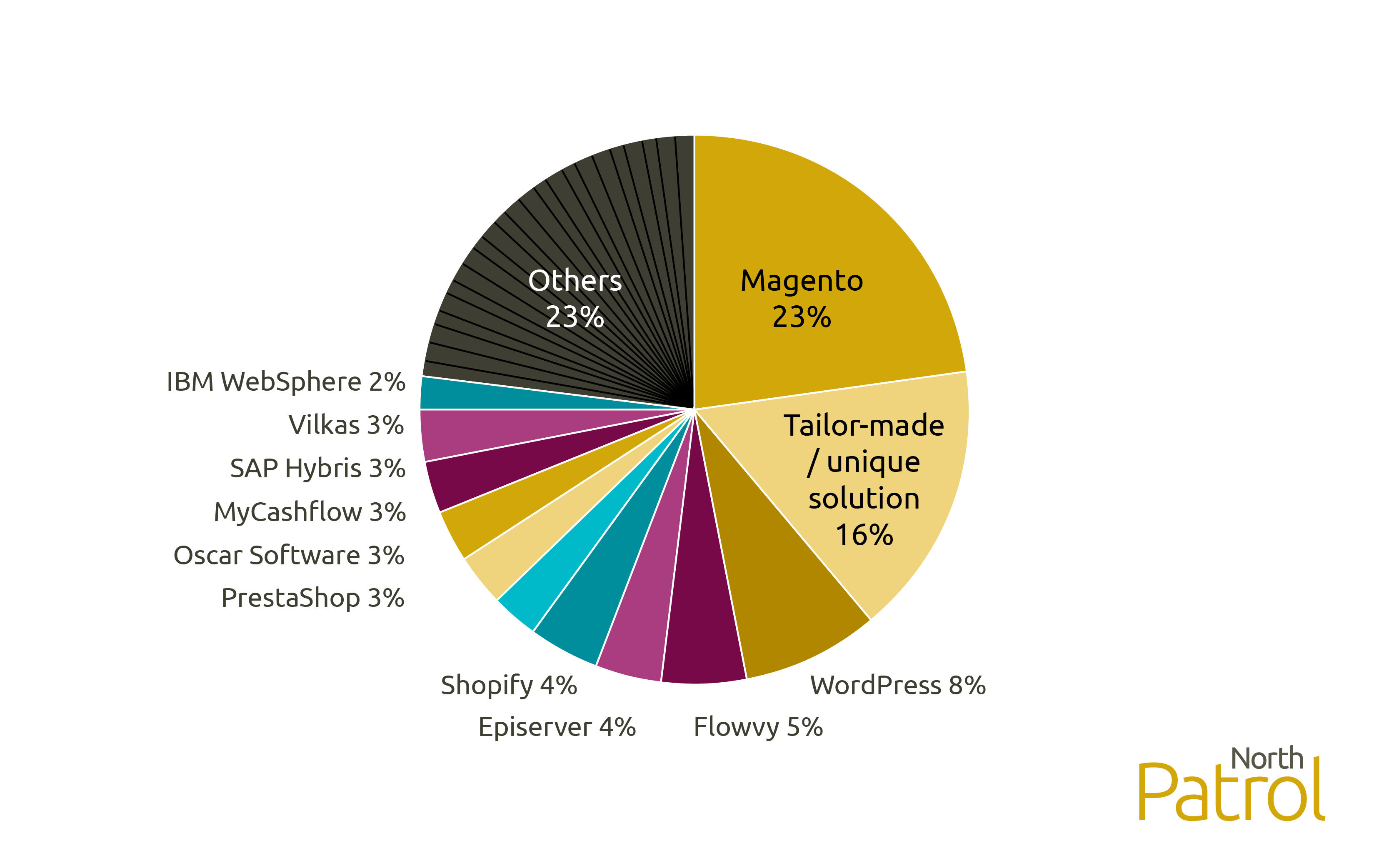

This year our eCommerce data review consists of 299 web shops. The criteria were the same as last years: The annual turnover of the company behind the web shop must exceed one million euros. Also, the selection must be reasonably large. Selling just gift cards is not enough.The amount of different eCommerce platforms has decreased from last years 50 to 48 even though our sample size is a little bit bigger. The change is small, but a clear sign of concentration to fewer technological solutions. The market share of small platforms has constantly decreased and most likely the same trend will continue in the future too.

North Patrol is a consulting firm specialized in the design of digital services and information systems. We shape ideas into a vision and service concept, find the best architectural and technological solutions, design a functional user experience, and compete to find the ideal partner for implementation work. We do not sell implementation projects, nor do we sell licenses; we are genuinely on the side of the customer.

Magento kept its top position as expected

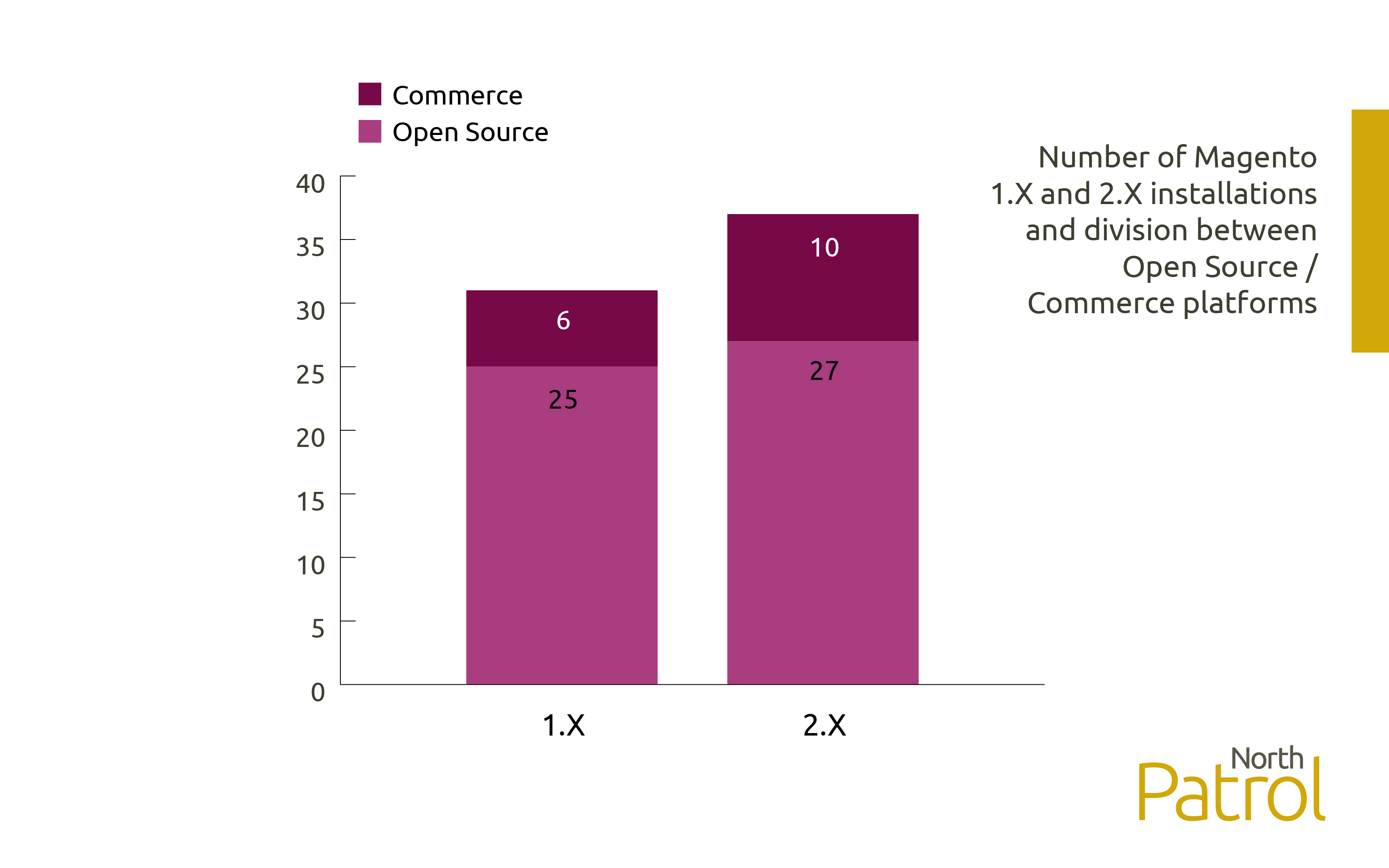

The market share of Magento is exactly the same as it was last year: 23 %. 78 % of all Magentos are Open Source versions and only 22% are Commerce versions, which is a little bit surprising with web shops of this size.

Surprisingly many Magento shops are currently facing big changes. The support for almost all Magento 1.X versions has ended. Of the Open Source Magento installations, in our sample data, the support has ended from 64%. The situation has practically not changed at all during the last twelve months! These businesses must decide what to do because the official product support has ended. It increases vulnerability risks and possible credit card issuer bans. Magento’s decision to end the support for 1.X versions and to develop the 2.X based on a totally new technical approach is not painless for their customers.

On the other hand, Commerce based Magentos have been diligently upgraded to meet the support requirements. They all are still getting support. About 38 % of them are, however, using Magento 1.X version (1.14.X). Therefore, it is likely that there will be changed to another platform soon. Luckily, Magento Commerce 1.14.X is still supported for some time.

This year Akateeminen kirjakauppa and Stockmann are exceptionally interesting Magento stores. They both are migrated from Commerce version to Open Source version probably because of the increasing costs of Magento licenses. Despite the license change Stockmann decided to use Magento 1.X version, which is not officially supported anymore. When writing this report, Stockmann has migrated again, this time to Salesforce.

The share of tailor-made solutions has increased

The tailor-made solutions take the second place also this year. However, their market share has grown significantly. This is caused mainly due to the classification criteria changes. Many web shops that were previously classified as unidentified, were moved to tailor-made class. If the technology stack hints about tailoring, and the business of the company is highly depending on the backend systems (such as ERP), it ends up more often to tailor-made class according to current analysis model.

In many cases tailor-made web shop is much better solution than bending an off-the-shelf software to fulfil the backend system’s requirements. This is especially the case, when the vast majority of the business logic is already implemented in the backend systems and the main responsibility of the web shop is basically to create the UI for these processes.

Examples of the tailor-made web shops: Ikea and K-Rauta have dumbed their IBM WebSphere based solutions and moved to tailor-made web shops. This change is probably accelerated by the slow development cycles of WebSphere, owner change and new requirements which cannot be fulfilled with an aging platform. For example, Ikea is putting more weight on rich user experience. The site is not only an electric mail order catalogue, but you can design a new kitchen or other rooms. K-Kenkä has changed Magento to a tailor-made web shop. Kesko seems to have chosen tailor-made systems as the main approach for all their web shops on a long run. One of the oldest representers in tailor-made class is HifiStudio. Its webstore has been in use for a very long time.

WordPress strongly on third place

The third place is taken by WordPress also this year. WordPress enables carrying out nice looking web shops with an affordable price. It allows bundling the advantages of the CMS and eCommerce system and change the electric mail order catalogue into a lively storyful content, where ordering is a bit more exiting experience. Similar, although wider possibilities, are achieved by using Episerver but the price tag is much higher compared to WordPress.

Examples of WordPress web shops: Makia has got international attention with its web shop. It offers exceptional concept when compared to other web shops. Also Tillander trust on WordPress. Designers have spent many hours on creating the frontpage of Tillander. Both of these sites represent very well, what utilizing the best advantages of CMS and eCommerce can do on the same site. The web shop of Helkama is very uncomplicated, even though it allows choosing different product variants.

Other remarkable market shares

Behind the podium rankings there has been much more changes. Episerver, holding the fifth position, is very close to Flowy, which is on fourth position. Shopify remains on the sixth place. PrestaShop ranks three places higher than last year and is seventh this year. SAP Hybris has dropped from fifth place to tenth and WebSphere from seventh to twelfth place. These changes are not quite as dramatic as the position changes would hint. The relative market shares are still close to what they were last year. Typically, we are talking about one percentage point changes. Despite this fact, we can predict that WebSphere will slowly disappear from the markets. Many bigger end web shops, for example K-rauta and Suomalainen Kirjakauppa, have changed it to another platform. Also, Hong Kong stopped using WebSphere for some time before it was merged with Rusta.

At least 28 % of web shop solutions are selected based on the backend systems

Many of the eCommerce products we found in this data review are such that nobody will choose them if they do not have at least some backend systems from the same suppliers. Flowy users most probably are using also Flowy’s POS system. Companies using Oscar Software have the ERP system from Oscar Software, similarly as the situation is with Enterprise Web and SAP Hybris. When we add on top of these Markus Cinema Systems, we get to 12 % combined market share. If we add the market share of tailor-made eCommerce on this, we get to 28 %. Naturally, also out-of-shelf products are sometimes tailored to fulfil the same needs. This estimation is of course not absolutely exact, but it tells clearly how strongly the backend systems are influencing to the eCommerce platform selection. This part will grow in the future when many companies decide to go all in with their eCommerce businesses from the current situation where they are more or less testing eCommerce with their other businesses.

There are two approaches when building the eCommerce: A web shop can be an independent store that has its own stock or it can utilize the stocks of all stores combined with its own stock. The latter choice may affect also to the systems used in the brick-and-mortar stores and thus has massive impact on business processes.

All off-the-shelf solutions support the separate stock approach very well. However, the shared stock approach requires tailoring and integrations to backend systems. An exception to this rule is, of course, productized eCommerce systems that belongs to the same product family with backend systems.

Magento will be the leader also next year

Even though the support of 64 % of Magento based web shops has ended, Magento will remain with strong market position also next year. The number of installations is so great, that it will not decrease significantly in one year. The biggest threat for the old versions is possible abandon by the online payment service providers. They will not be very flexible, if the unsupported Magento versions will face large attacks. In the worst-case scenario, the online payment service providers will stop serving web shops using old Magento versions.

Which stores will continue using Magento platform? Magento 2.X is very different product to Magento 1.X. The vast majority of those 1.X users that start using 2.X have already migrated. The rests will continue taking the pain until they must decide. Of course, some have not, even for now, noticed the upcoming serious problems. Because Magento is focusing on more demanding eCommerce solutions, it is possible that its market share will drop to half within the next few years.

Ending up to a tailor-made solution is usually based on a comprehensive analysis. The market share will not change significantly during the next years. The market share can grow a little bit due to the change to more serious eCommerce business when the experimental web shops becomes real businesses.

It is easy to forecast bright near future for WordPress based eCommerce. It could very well be a good choice for many smaller Magento users. The same applies to those businesses, which are using the eCommerce systems provided by for example their ERP vendor. They may want to distinguish their web shops with visual themes and storytelling from their competitors.

The best web shops mix storytelling and products in a good proportion and dispenses it to their customers with great commercial success. The vast majority of domestic web shops still look like electric versions of mail order catalogues directly form the eighties, but the wind of change is blowing. This can strengthen the position content management system based eCommerce systems.

If you need assistance in evaluating what system would support you in achieving your business objectives or in comparing different products, do not hesitate to contact us.